In NSW, foreign buyers are being charged a 4 per cent stamp duty surcharge from June 21. In Victoria, foreign buyers are charged a 7 per cent tax, and in Queensland foreign buyers are being charged a 3 per cent surcharge. All three of these taxes are specifically targeted on transactions of property by foreign buyers.

Property (both residential and non-residential) is already the largest source of taxation revenue for state and local governments. These additional charges to foreign investors in the three most populous states will likely raise additional revenue, as long as the higher cost of doing business does not result in a downturn in demand from overseas buyers.

For each government, there is a benefit in these changes outside of additional revenue – foreigners don’t vote, and politically it is likely to be a fairly popular decision, especially in NSW and Victoria where housing affordability is a growing problem and there is a growing perception foreign investors are bidding up prices and contributing to locking first home buyers out of the market.

In NSW, state and local governments collected $14.705 billion in property taxes over the 2014-15 financial year. Property tax revenue increased by 12.8 per cent over the year and increased by 80.5 per cent over the decade to 2014-15. Property taxes accounted for 48.5 per cent of total taxation revenue to NSW state and local governments in 2014-15.

In Victoria, state and local governments collected $12.246 billion in property taxes over the 2014-15 financial year, which accounted for 53.1 per cent of total taxation revenue. Property tax revenue increased by 10.7 per cent over the 2014-15 financial year to be 109.9 per cent higher over the past decade.

Queensland property tax revenue increased by 12.6 per cent over the 2014-15 financial year to be 80.7 per cent higher over the decade. In the 2014-15 financial year, Queensland’s state and local governments collected $8.267 billion in property tax revenue, which accounted for 51.5 per cent of total state and local governments’ tax revenue.

Over the decade to June 2015, property taxes increased by 80.5 per cent in NSW, 109.9 per cent in Victoria and 80.7 per cent in Queensland. Over the same time frame, inflation increased by 30.1 per cent, significantly lower than growth in property taxation.

Given the importance of property tax revenue to state and local governments, it is no wonder that the three largest states decided to increase taxes on foreign investment. These changes do not affect voters and they collect additional much-needed revenue.

My concern is that it shows that none of these states have any intention of moving away from transactional taxes on property to more efficient land taxes. Keep in mind that in a typical year, only around 5 to 7 per cent of residential properties are transacting, so stamp duty is only being collected from a small proportion of buyers who decide to move. When transactions and values slow or fall, stamp duty revenue is also susceptible to large declines.

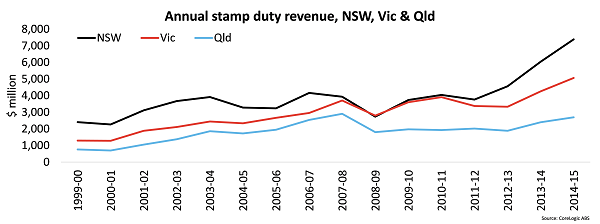

In NSW and Victoria, governments are gaining substantial revenue from stamp duty as property values and transactions rise. In NSW, stamp duty collection rose 22.2 per cent in 2014-15, while in Victoria it rose by 18.9 per cent and in Queensland it was 12.3 per cent higher. Over the past decade, the total increase in stamp duty revenue has been recorded at 125.1 per cent in NSW, 116.8 per cent in Victoria and 56.1 per cent in Queensland.

Some of the commentary about the increases in tax have been around the fact that without foreign investors, many of the new housing (particularly unit) projects would never have even commenced construction. To me, this is really the crux of the problem. As the resource investment boom has faded to some extent, housing construction has helped to fill the void. If a project’s viability is totally dependent on foreign demand, to me that suggests that it is not really a viable project. The reality is that the current home value growth phase has now been running for four years and new housing construction, and unit construction in particular, has hit record highs. Foreign investment has increased quite significantly over this time, however, many of these purchasers are buying units which many locals wouldn’t touch due to their size, location and price. Furthermore, anecdotally many of these properties don’t actually create additional housing because they are left empty and not made available for rent.

I believe that these additional charges will provide some deterrent for foreign buyers investing, as the costs continue to add up with application fees to the Foreign Investment Review Board. Of course, while these changes may deter some investors, others will just see it as a cost of doing business and it shouldn’t impact them too much if they are investing for the long term. If fewer foreign investors results in some new housing projects not going ahead, that is not necessarily a problem either in light of the fact that housing supply has increased dramatically over recent years and will continue to do so over the coming years given the housing currently under construction. Finally, if it means that certain developers decide to rotate their offering away from one catering to foreign buyers and towards one which is more palatable to a local market, I believe that is a good thing.

Ultimately, these changes may deter some foreign investment, but they are not going to scare off all foreigners from investing in the housing market. At the same time, it will raise much-needed revenue for state governments. If state governments are looking at taxes on property, I would once again call on them to look for a way to move away from stamp duty to a more efficient land tax.