The term ‘FinTech’ has become more and more widespread in the last decade and whilst there is no coined definition, it is most generally understood as companies who leverage technology to revolutionise product offerings within the finance industry. With this increased awareness surrounding the benefits of fintech’s greater reliability, efficiency, and speed, the sector is on track to become the first choice for property financing in Australia.

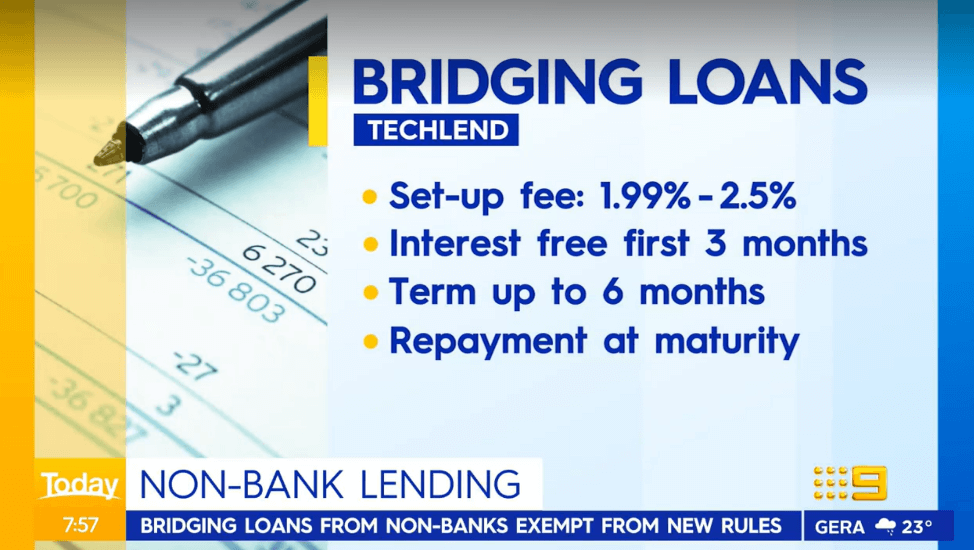

Earlier this month, TechLend was featured on The Today Show by finance editor and money expert, Effie Zahos. Zahos was quick to speak to fintech’s ability to encompass forward-thinking and dynamic processes that have transformed the way homeowners buy and sell property. New bridging loan specialist TechLend has hit the ground running since its establishment in July 2021, recently launching its new eligibility-based algorithm that gets borrowers with no-end debt pre-approval for a bridging loan in just one hour, leaving the big banks with largely manual systems struggling to keep up.

Courtesy of its commitment to constantly grow and embrace its proprietary technology, TechLend leverages property data and values to offer bridging loans faster than ever. Borrowers simply apply online through a simple five-minute application and their technology runs the data through an eligibility calculator, resulting in instant bridging loan pre-approval. In addition to TechLend’s fast processes, as stated by Zahos, borrowers also have the advantage of:

- Convenience: get pre-approval for a bridging loan an hour before an auction

- Flexibility in payments: do not pay for the bridging loan until the sale of your existing property

- Avoiding rent: buy a new property before you sell your existing to avoid months in a temporary living situation

Here’s how TechLend helped a recent customer:

A recent success for TechLend was a Melbourne property owner who hoped to make the move inland with his family of five to their dream home in the Dandenongs. Previously, the homeowner had spent four years living in Austin, Texas, while he worked for a major financial institution, however, decided to make the move back home to Melbourne.

Having moved countries and changing jobs in the process, getting approval for a bridging loan from a traditional lender was going to take weeks, if not, months. Within an hour of reaching out to TechLend, this property owner had secured funds to cover 100% of the purchase price plus stamp duty. They also undertook some renovations before the sale of the original property with part of the TechLend bridging finance.

To find out more about TechLend’s Bridging Loans and product offerings, visit https://techlend.com.au/