In an update to the ASX, YBR released its unqualified audit-reviewed half-year report for the six months to 31 December 2018.

The figures show a net loss after tax (NLAT) of $34.15 million, which largely comprises a non-cash asset write-down of $33.95 million ($30.96 million after tax) on the carrying value of the wealth management and lending business – as well as other intangible assets across the group.

One remaining strategic intangible asset remains, which is believed to relate to the development of YBR’s own securitisation product.

The balance sheet reset therefore means that no goodwill is being carried forward.

The group reported that underlying earnings before interest, depreciation and amortisation (EBITDA), excluding non-cash asset write down, was $2.46 million loss (compared to a $2.10 million profit for the prior corresponding period), while the underlying Cash EBITDA (excluding non-cash asset write down and non-cash PV-based revenues) was a $1.27 million loss (compared to $2.06 million profit last year).

The group said that the write-down comes following “detailed consideration of the goodwill and other intangible assets in the context of the cumulative effect of challenging consumer and market trading conditions, the response from the banks to increased macro-prudential oversight, sentiment resulting from the [banking] royal commission and uncertainty regarding proposed changes to the future regulatory environment.”

It is a non-recurring non-cash balance sheet adjustment and has no impact on underlying EBITDA or operations of the business.

The group has suggested that as well as the “simplified” balance sheet, the board and management are currently undertaking a “broad strategic and operational review to simplify the business, including assessing the wealth management business and business structures, to ensure YBR remains competitive”.

The board will reportedly provide an update on this by the end of April 2019.

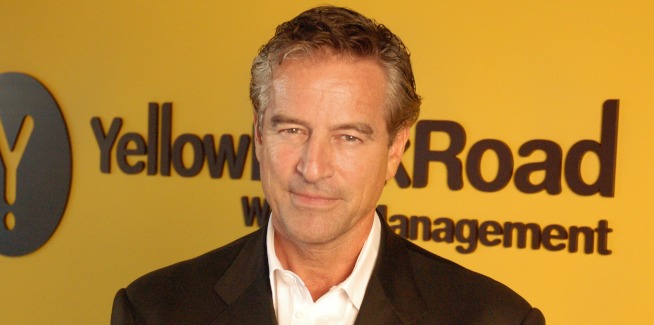

Speaking to Mortgage Business, Mark Bouris, executive chairman of YBR, said: “I think most investors today understand that impairing goodwill and/or intangible assets (as opposed to tangible assets) just takes out of your balance sheet something you acquired some years ago and reflects – to some extent - the concerns others might have around what the Hayne royal commission has recommended...

“If you look at the Hayne recommendations, someone might think well you’re never going to get any value out of being a broker any more of having distribution because Hayne has said you have to go and charge your clients.”

However, Mr Bouris added that since the release of the report, there have been a number of iterations, both publicly and privately, by both of the two major parties that “they are trying to keep brokers whole, in one way or another”.

He continued: “In terms of reflecting the recommendations of the royal commission in our accounts… the board took a conservative view to simplify the balance sheet and write down $2 million of goodwill and the goodwill of distributions we have acquired and to write down to nil a number of other intanglible assets.

“So we kept only one intangible asset on the balance sheet which is in for less than $1 million – which is money we spent on developing our own securitisation product – and that resulted in us writing off $33.95 million of goodwill and intangibles.”

The executive chairman said that the new “conservative position” was being made “just to make sure we meet community standards and we effectively have been playing the new ‘financial correctness’ expectations.

“Whether we agree with it or not, we have to be financially correct. And the financial correctness is to write that asset off,” he said.

[Related: YBR loan settlements fall, cash deficit narrows]