The data showed that the strength in residential dwelling approvals is continuing. Over the month there were 20,788 dwellings approved for construction which was a moderate -1.8% lower over the month but 10.1% higher than the number in August last year.

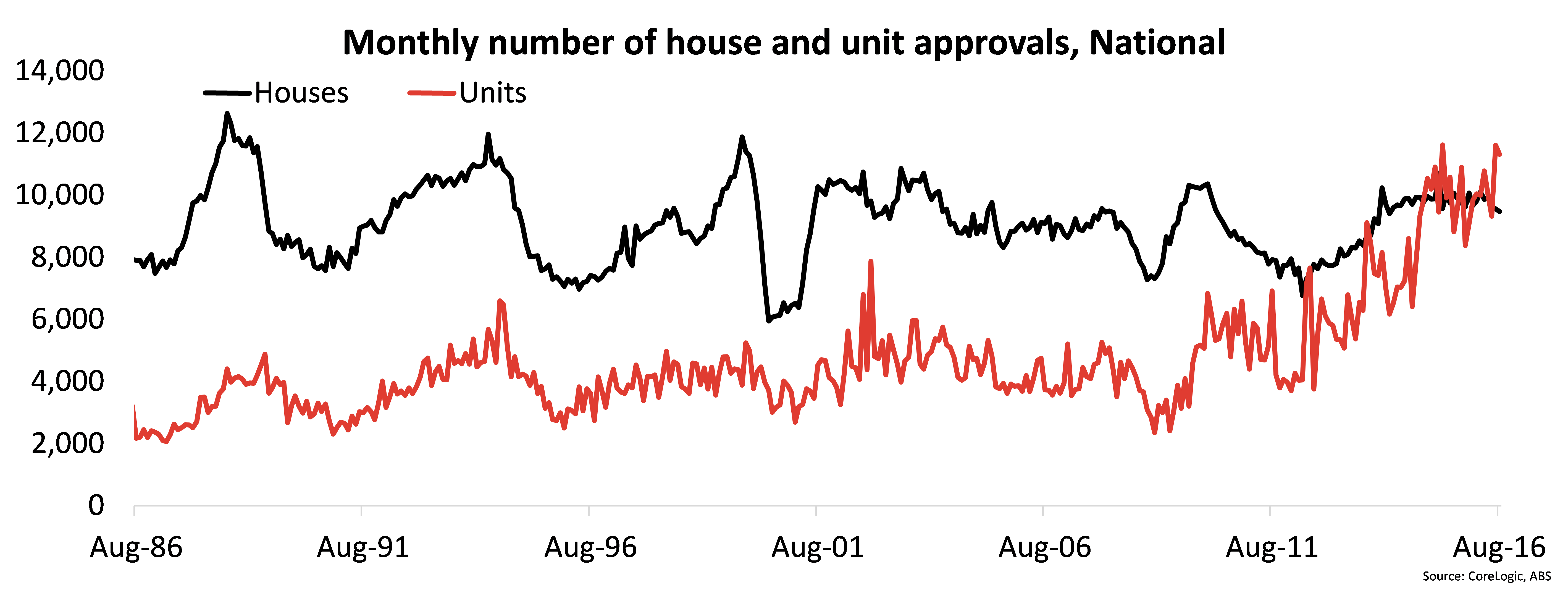

The 20,788 dwelling approvals were split between 9,475 houses and 11,313 unit approvals. Over the past year, on seven occasions there have been more units approved for construction than houses which highlights the growing shift towards densification with a particular emphasis on high rise unit developments. The number of houses approved for construction fell by -0.9% over the month to its lowest level since March 2014. House approvals in August 2016 were -5.8% lower than at the same time in 2015. The number of units approved for construction was slightly lower over the month, down -2.5% however, compared to the number in August 2015 they were 28.3% higher. Despite the slight fall in approvals over the month they still remain at very high levels on an historic basis indicating that there remains a level of confidence from property developers that they can continue to bring new stock to the market and attract a sufficient level of demand to make a profit.

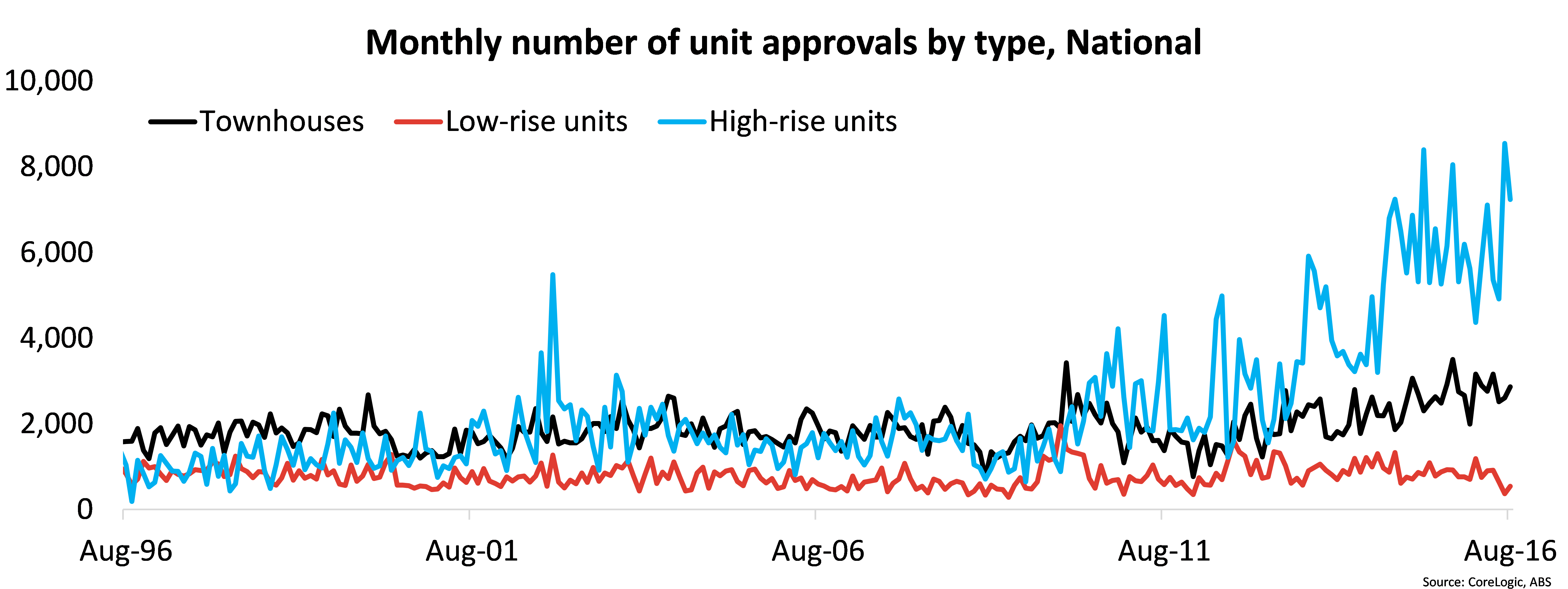

Focusing on unit approval over the month, 26.9% of all approvals were for townhouses, 5.1% were low-rise units (defined as less than four storeys) and 68.0% were for high-rise units (four storeys or higher). To highlight the prevalence of high-rise unit development, if we look over the four years to August 2016 there have been 112,153 townhouses approved for construction, 43,471 low-rise units and 232,232 high-rise units. High-rise unit approvals over that four year period have been more than double the number of townhouse approvals which historically been the dominant type of unit approval.

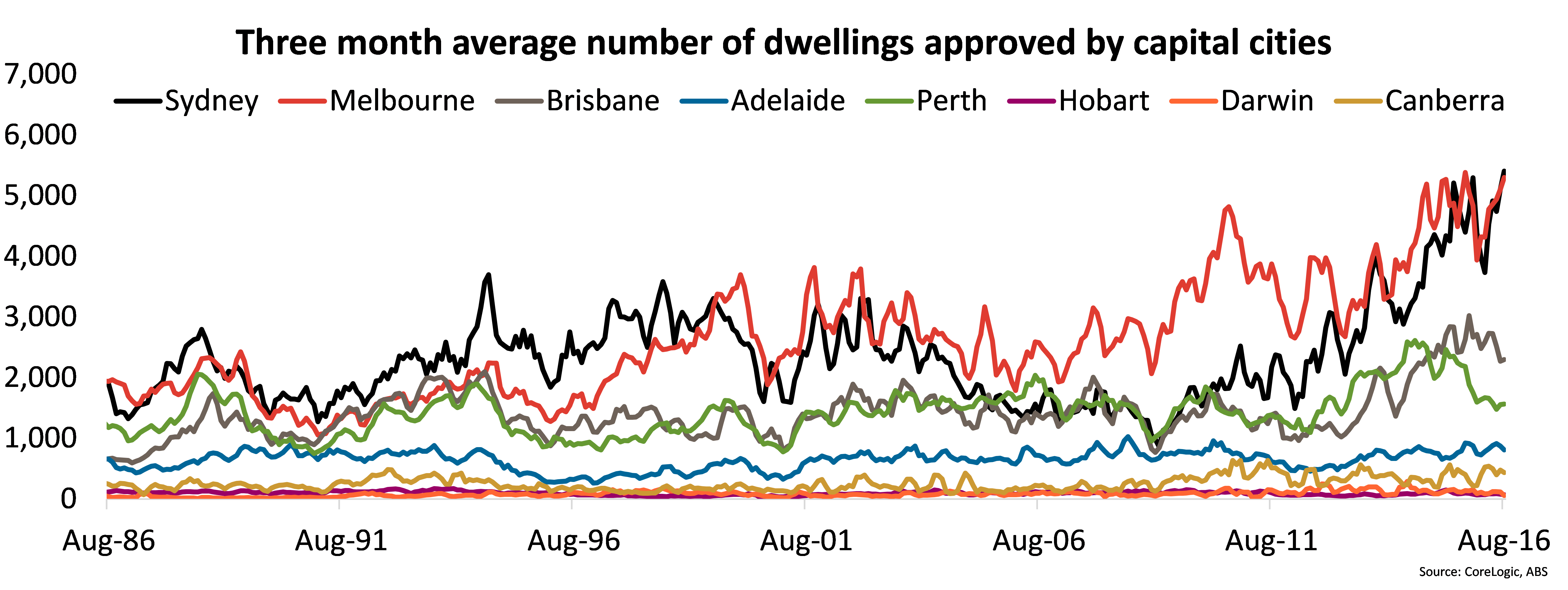

Across the combined capital cities, there were 16,763 dwellings approved for construction in August 2016. Capital city dwelling approvals were -4.3% lower over the month but 15.3% higher year-on-year. Melbourne (+1.4%), Hobart (+58.2%) and Canberra (+9.6%) were the only capital cities with a higher number of dwelling approvals over the month. Year-on-year the number of dwelling approvals were higher in Sydney (+45.8%), Melbourne (+21.3%) and Brisbane (+29.0%) but lower in Adelaide (-13.8%), Perth (-38.3%), Hobart (-4.4%), Darwin (-28.4%) and Canberra (-6.6%).

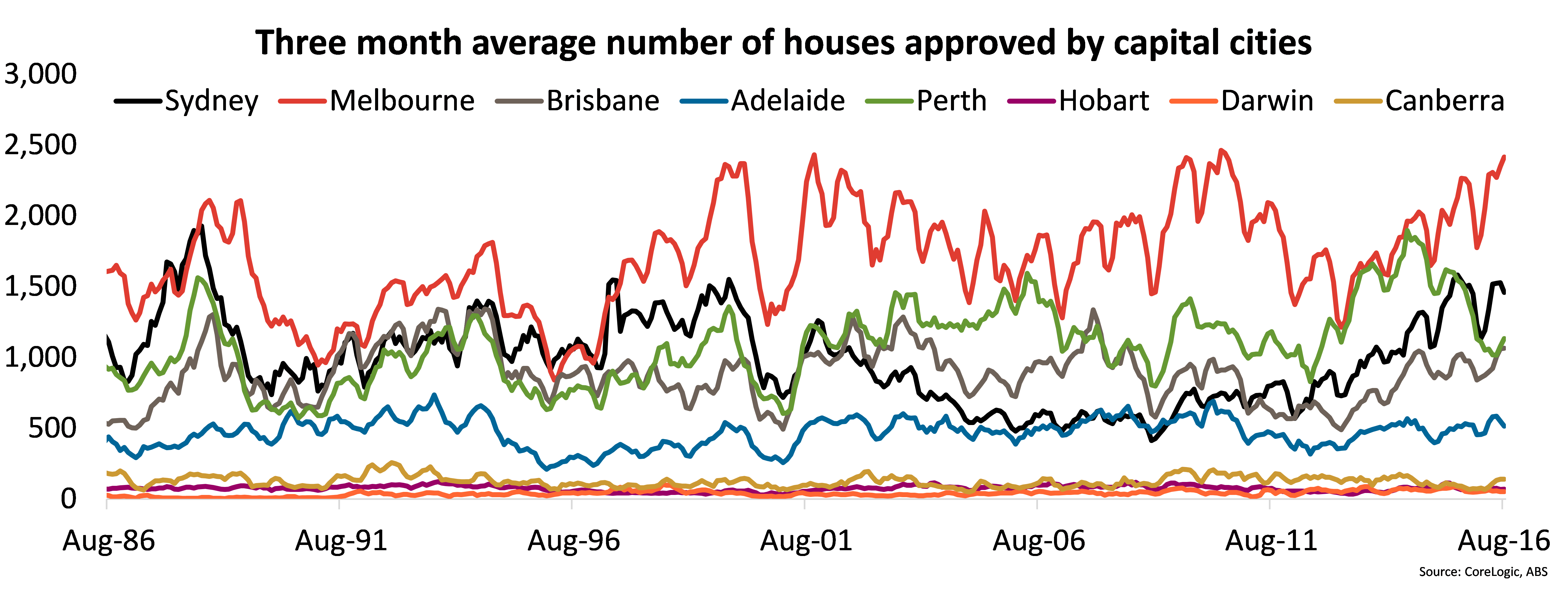

In August 2016 there were 7,264 capital city houses approved for construction which was the highest number of approvals since July 2015. Capital city house approvals increased by 10.2% over the month and were 4.7% higher year-on-year. The number of houses approved for construction in August was higher across all capital cities. Year-on-year house approvals were higher in Sydney (+4.3%), Melbourne (+18.0%), Brisbane (+15.1%), Hobart (+8.8%) and Canberra (+62.1%), were unchanged in Adelaide and were lower in Perth (-20.6%) and Darwin (-23.2%). Perth and Darwin are seeing falling sales, rents and home values and it seems the development industry is responding by seeking fewer new house approvals.

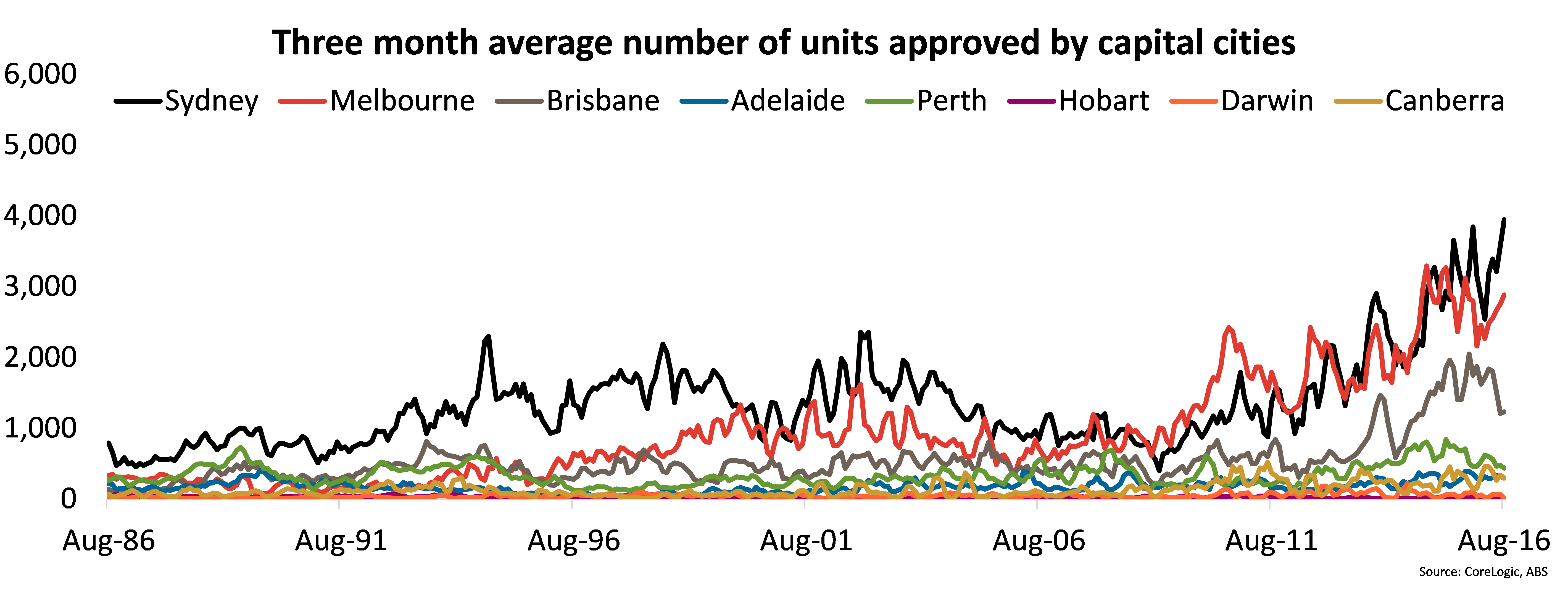

There were 9,499 units approved for construction across the combined capital cities in August 2016. Although unit approvals were -13.1% lower over the months, they were 25.0% higher year-on-year. Although unit approvals were lower over the month it was the 23rd consecutive month that house approvals were lower than unit approvals. The number of capital city unit approvals were lower over the month across all cities except for Canberra which were 9.9% higher. Looking at the year-on-year changes in approvals, they were lower in Adelaide (-39.2%), Perth (-67.1), Canberra (-18.5%) and Hobart and Darwin where there were no approvals in August 2016. Unit approvals were higher year-on-year in Sydney (+71.1%), Melbourne (+24.3%) and Brisbane (+43.0%). Interestingly the number of units approved for construction is trending higher again in Sydney and Melbourne (although they fell a little in August) while in most other capital cities they are falling.

We’ve been expecting the number of dwelling approvals to start trending lower for some time and to-date it just hasn’t occurred. We anticipate that approvals will slow over the coming year however, they are likely to remain high on an historic basis. With tighter lending policies, particularly for investors it is reasonable to expect that once the slowdown occurs, it is likely to impact on the unit market more so than the detached housing market which tends to be dominated by owner occupiers more than investors.