Based on the seasonally adjusted series, the number of dwelling approvals rose by 7.0 per cent over the month due to a substantial rebound in unit approvals. Despite an increase in approvals in November, they are 4.8 per cent lower over the year and are 18.6 per cent lower than their peak in October 2015 when 21,588 houses and units were approved.

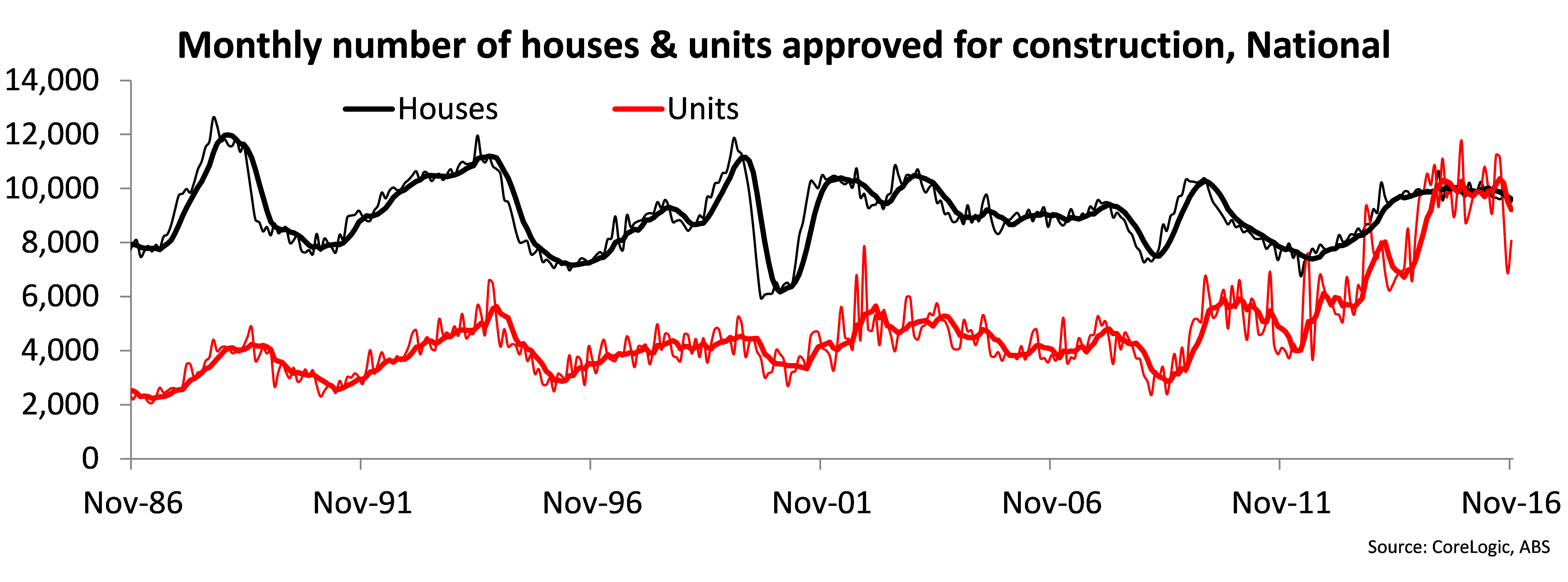

In November 2016, there were 9,503 houses and 8,066 units approved for construction throughout the country. Over the month, house approvals fell by 0.4 per cent while unit approvals increased 17.3 per cent.

Unit approvals tend to be lumpy and volatile, which goes a long way towards explaining the 17.3 per cent increase in November following a 20.1 per cent decline in September and 22.8 per cent fall in October of last year.

Year-on-year, houses approved for construction were 2.1 per cent lower and unit approvals were down 7.8 per cent.

Over the current construction cycle, house approvals peaked at 10,649 in April 2015 and unit approvals peaked at 11,763 over the month of October 2015.

November 2016 house approvals were 10.8 per cent lower than the April 2015 peak while unit appears have fallen more dramatically, down 31.4 per cent from their October 2015 peak.

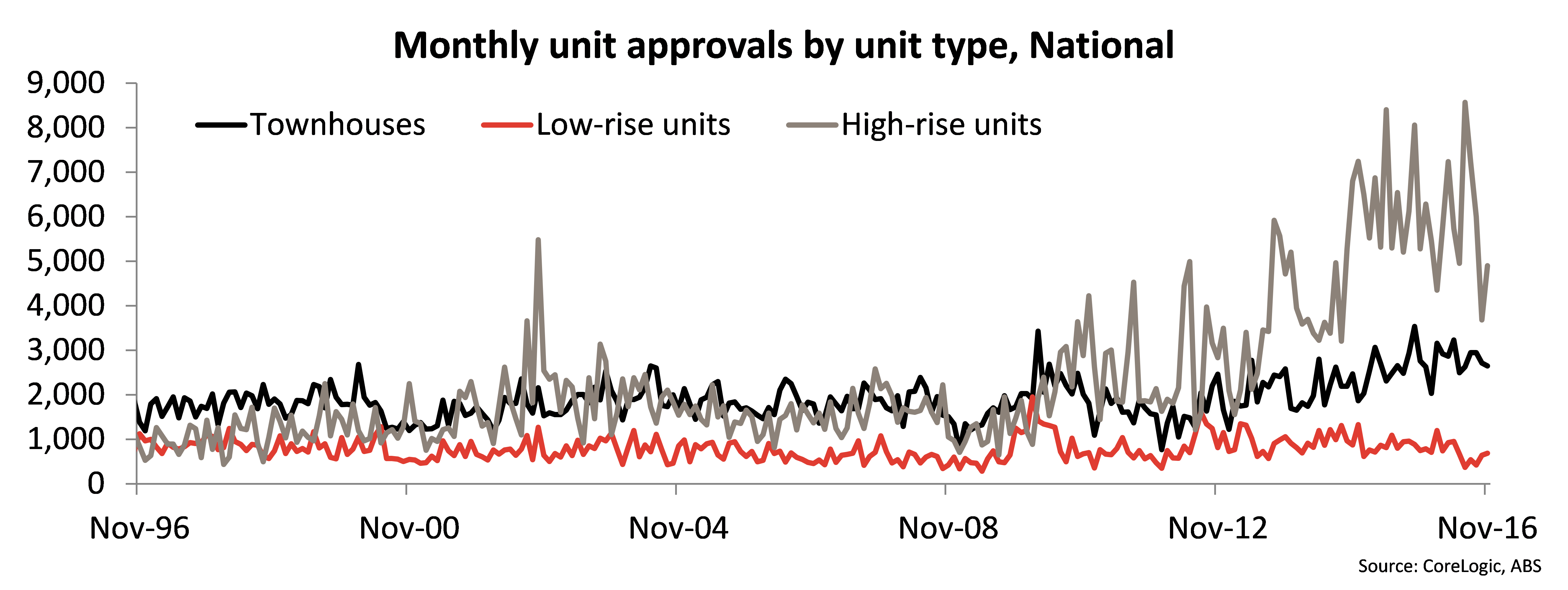

Looking deeper into unit approvals by type, it becomes clear that the surge in new high-rise construction projects has slowed.

This data is split into three segments: townhouses, low-rise units (less than four storeys) and high-rise units (four storeys or higher).

The above chart highlights the volatility in unit approvals and also shows that the recent plunge of unit approvals is being driven by the high-rise unit sector.

With ongoing concerns about oversupply of high-rise units in certain inner city markets and slowing value growth for units, it seems that developers are responding by seeking fewer new high-rise unit approvals.

Another interesting trend over the past year or so has been the steady upwards trend in townhouse approvals. The substantial increase in high-rise approvals over recent years has occurred at the expense of townhouse and low rise approvals.

With the expected further slowing of high-rise unit approvals, there is potential for a lift in townhouse approvals over the coming year.

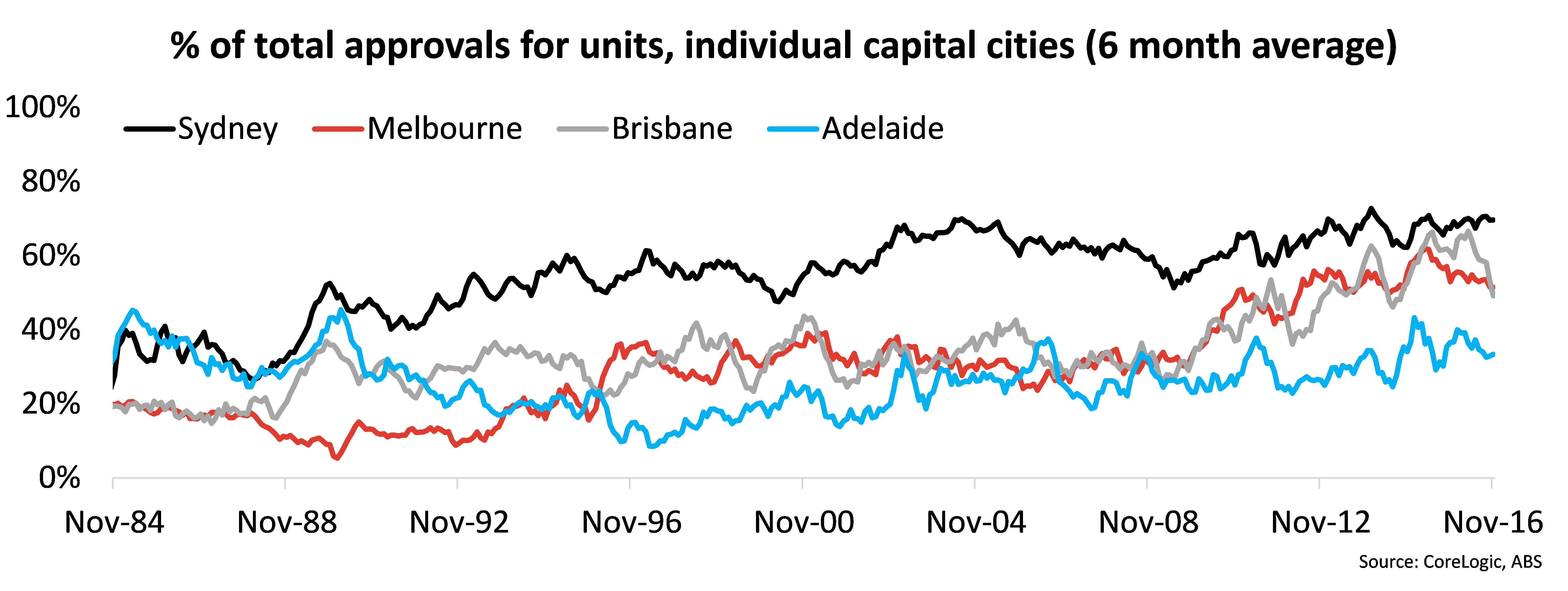

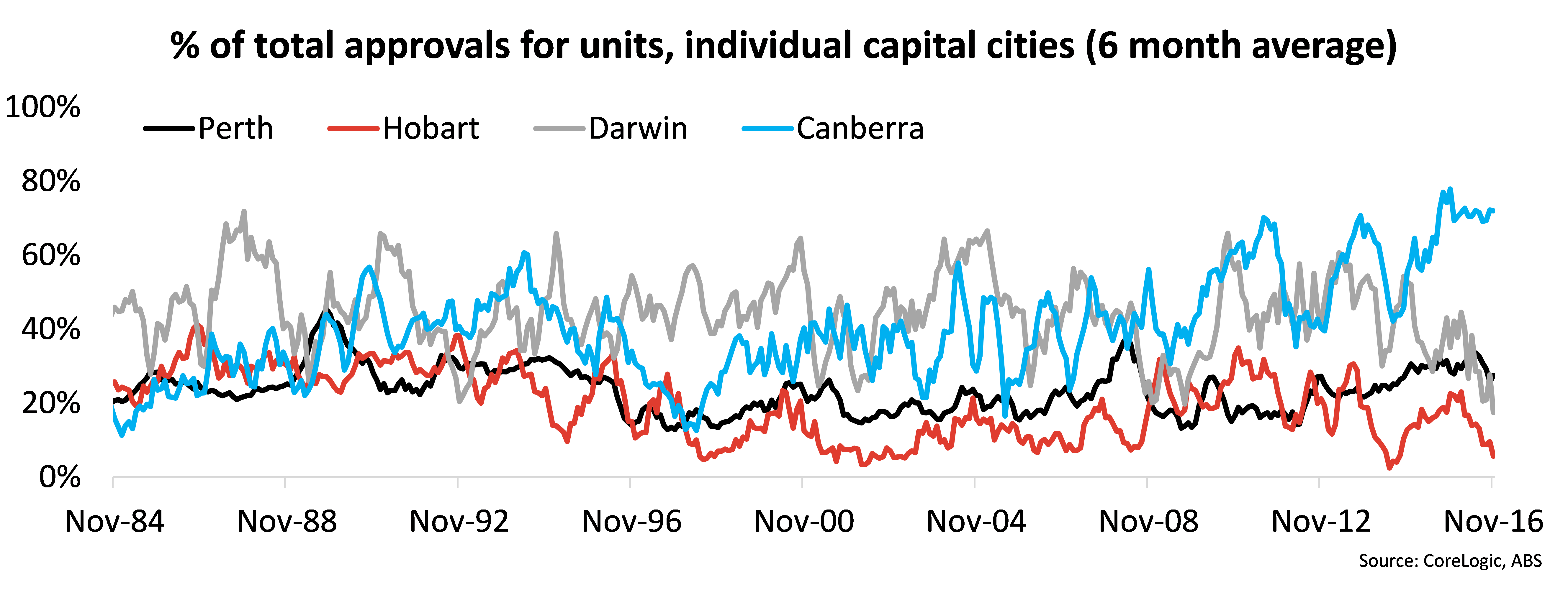

The two above charts show the proportion of dwelling approvals that were for units. The data points to the fact that in most capital cities developers have recently slowed their submissions for unit building approvals.

As a proportion of all approvals there have been some significant declines in unit approvals in Melbourne, Brisbane, Perth, Hobart and Darwin over the past six months.

The reality is that this is an appropriate response in most of these cities given how much unit construction has been taking place.

Hobart is the one exception where it could be argued that more unit construction is required, particularly given the booming tourism sector. Sydney and Canberra have recorded no significant slowdown in unit approvals as a proportion of total approvals over recent months. Sydney has been approving more units than houses for more than two decades where in most other capital cities the dominance of unit approvals over those for houses is a relatively new phenomena.

Unit approvals are trending lower, particularly for high-rise units, which is an appropriate response so late in the current construction phase. The reality is that at least initially, an increasing proportion of these units approved for construction may not be sold.

There remains a substantial pipeline of construction work already underway which should keep residential builders busy for some time. Should, as we expect, approvals soften further and remain well below their recent heights over the coming years absent a pick-up in non-residential or infrastructure construction, there could be some headwinds for builders and associated businesses.

Housing construction has been a significant driver of economic growth over recent years and a slowdown in this sector could also impact on economic growth over the coming years unless some other large industry segment can pick up the slack.