As stated by Yellow Brick Road (YBR), the app, named Y Home Loans app, was launched earlier this week (11 May) on both iOS and Android, offering users the same variety of online lending options that exist on the eponymous website.

YBR first flagged the goal of launching a Y Home Loans app earlier this year, then stating that it would mirror the digital mortgage website’s capabilities for home loans, while also nudging and notifying borrowers to contact YBR brokers.

However, in a release confirming the app’s launch, YBR noted that its wider vision for the Y Home Loans digital platform is to build on “emerging borrower behaviour” and offer a complete online mortgage experience.

Further, YBR said that the long-term approach for this digital offering is to “develop a borrower-driven experience to compete in the growing online market of fintechs and lenders”.

This is said to comprise of providing a “broad range of options and lenders” alongside access to both YBR branches and brokers.

According to YBR, the Y Home Loans digital platform also “utilises machine-learning and sentiment analysis to better understand the needs of property buyers, using a data-driven approach to shape the development of the content and direction into the future”.

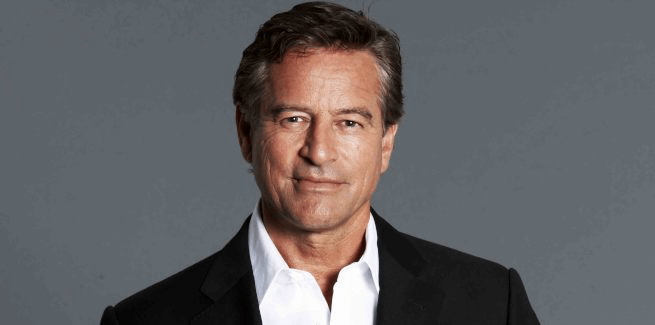

Speaking on this vision, YBR executive chairman Mark Bouris commented that this focus is about “arming everyday Australians with the right knowledge” such as buying, investing or selling.

In addition to the online borrowing resources, the app also includes a learning centre, as well as YBR’s educational podcast series.

Coined “Property Insights: Learn from the Experts” and hosted by Mr Bouris, the catalyst for the weekly podcast is said to be the recognition that most audiences already receive their financial finance information either online or through social media.

“Instead of simply posting through another social platform, I decided to step it up a notch and launched my own platform, bringing together experts that you simply can’t find anywhere else online,” Mr Bouris said.

Further, the podcast is said to also be influenced by the app’s user activity, with datasets generated within the app said to “provide clear signals on the types of content and information most relevant to property buyers” such as timing, viewer duration, location and demographics.

“This will allow YBR to monitor and adjust its approach to deliver relevant and timely content within each episode, ensuring the needs of property buyers are in focus,” the group said in a statement.

“We’re getting closer to the decision-making phase that borrowers will eventually go through to provide them with content that will help overcome the challenges when buying property,” Mr Bouris noted.

[Related: YBR outlines growth strategy, flags app launch]