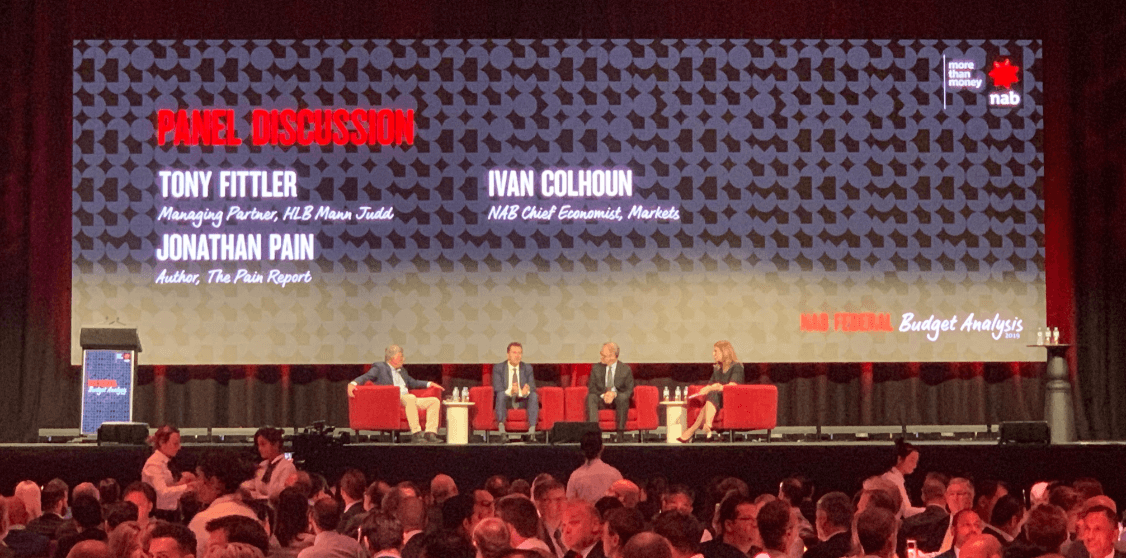

Speaking on a panel at NAB’s Federal Budget Analysis event on Wednesday (3 April), Jonathan Pain, economist and author of The Pain Report, said he expects the Reserve Bank of Australia (RBA) to cut the official cash rate four times in the next two years to a new record low of 0.5 per cent.

“I think the Reserve Bank is going to cut rates as soon as this election is out of the way. If we didn’t have this election in May, I think the Reserve Bank would have already been cutting rates,” Mr Pain said.

The reason the economist and author believes the RBA will decrease the cash rate by 1 percentage point (from 1.5 per cent to 0.5 per cent) is because it is unlikely that the banks would pass on the central bank’s entire rate cut to their customers.

“I’m saying 1 per cent because the banks will arguably only pass on about 60 to 65 per cent of that,” Mr Pain said.

“Don’t forget, last time they didn’t pass it on for a range of reasons. Banks always want to protect their margins.”

NAB’s chief economist of markets, Ivan Colhoun, who was on the same panel, said he believes customers would be the beneficiaries of a reduced cash rate, noting that the “minor interest rate increases” seen last year was because “funding pressures moved against the banks”, forcing them to raise their rates.

“Those pressures have been coming off recently,” Mr Colhoun said, noting that this could change.

Meanwhile, NAB is anticipating two RBA cash rate cuts by the end of 2019 to 1 per cent – a view that was expressed by a number of industry pundits.

Mr Colhoun even said a rate drop could be seen as early as next month in the lead up to the federal election.

“If they don’t cut, I think the unemployment would begin to move up,” the chief economist said.

However, he implied it might be too early to tell whether there would be any further rate cuts next year.

“If the economy turned out weaker, then the RBA would keep cutting,” Mr Colhoun said, noting that NAB’s outlook is based on the assumption that the economy would continue growing at a “reasonable” pace.

Both Mr Pain and Mr Colhoun agreed on the importance of the cash rate, which some leaders had previously lamented lost significance as it had not deterred lenders from lifting their interest rates out of cycle from late last year.

“Does it matter? Absolutely, because the majority of our mortgages in Australia are of the variable rate nature, floating rate nature. Whereas in the United States, for example, most of them are on fixed rates.

“What the cash rate setting the Reserve Bank has is very important for us from a business perspective and from a mortgage perspective.”

[Related: GDP growth projections to fall short, says NAB economist]

;

;