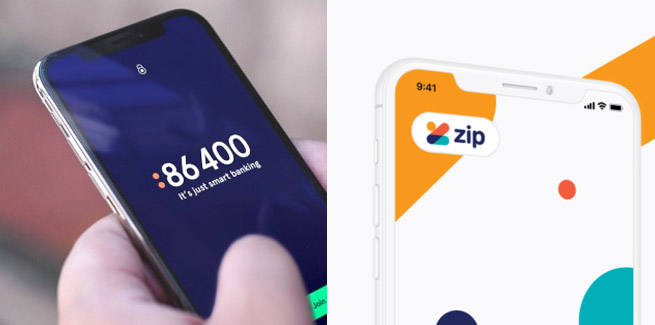

Neobank 86 400 and “buy now, pay later” service Zip Co have announced an ongoing partnership, which will see an integration of services that will allow Australians to better control their money.

The partnership will see 86 400 customers given the ability to link and view their Zip Pay and Zip Money accounts within the 86 400 app, with transactions and balances both visible within the banking app.

86 400 now allows customers to connect and view financial accounts from over 100 institutions within the neobank’s app.

According to the neobank, the partnership will soon see the integration of 86 400’s customer service engine with Zip’s consumer products, which will reportedly provide customers with greater visibility to their finances.

Further details on the partnership will be announced “in due course”, according to the fintechs.

86 400 CEO Robert Bell said: “Zip and 86 400 are like-minded, purpose-driven businesses. We were both built to give Australians better experiences with their money, and so by working together, we can accelerate our shared mission.”

Zip Co CEO Larry Diamond said the partnership will enable Australians to “get more out of their money.”

“Millions of Australians are looking for new and better ways to pay and are adopting smarter technologies, such as 86 400 that help them better manage their banking,” he said.

“It was an absolute pleasure working with 86 400, a digital-first organisation like Zip, where customers can now access the latest in everyday banking.

“We are equally as excited about new features that make it even easier for customers to leverage both companies’ offerings within a seamless digital experience.”

“Both Zip and 86 400 invest heavily in technology, and we have a single-minded focus on doing what’s right for the customer, every second of every day,” Mr Bell said.

[Related: Finance executives banking on technological innovation]

;

;