Speaking at the Financial Review Banking Summit 2022 on Tuesday (31 May), the chair of the Australian Prudential Regulation Authority (APRA), Wayne Byres, flagged growing risks and losses in mortgage portfolios.

In his speech, “A fit-for-the-future banking sector”, the prudential regulator’s chair highlighted that “the next few years will be far from plain sailing”, particularly given the “legacy of the pandemic, the resurgence of global inflation, and ongoing geopolitical tensions”.

Mr Byres noted that while Australia has a “strong financial system, well-equipped to handle bouts of bad weather and changing conditions”, there will be a deterioration in mortgage portfolios moving forward as rates rise, cost of living bites and house prices soften.

This is a particular priority for APRA given that housing loans make up more than 60 per cent of the banking industry’s total loan portfolio, and have been growing over time, he added.

Mr Byres told delegates: “Historically, housing loan portfolios have been low risk, and acted as ballast for the industry through turbulent periods. Large credit losses have traditionally come from elsewhere – most notably, from corporate lending and commercial property. Housing loans have been, as they say, as safe as houses.

“That may not be the pattern in the future.

“Aggregate dollar losses from housing portfolios now regularly exceed that from other portfolios in our stress tests.”

While Mr Byres acknowledged that this could “simply be a product of the calibration of the stress test itself”, he added that it “more intuitively” reflects the combination of a growing proportion of housing loans in the total book, and “rising risks within those portfolios from a larger share of more heavily indebted borrowers”.

APRA ‘watching closely’ those with high DTI

The APRA chair noted that the regulator had already been increasingly active (and interventionist) in recent years about the quality of housing lending (for example, it brought in new serviceability buffers in October last year).

“We are now entering a very different environment than has existed for much of the past decade,” he continued.

“The faster-than-expected emergence of higher inflation and interest rates will have a significant impact on many mortgage borrowers, with pockets of stress likely, particularly if interest rates rise quickly and, as expected, housing prices fall.

“Of particular note will be residential mortgage borrowers who took advantage of very low fixed rates over the past couple of years, and may face a sizeable ‘repayment shock’ (possibly compounded by negative equity) when they need to refinance in the next year or two.”

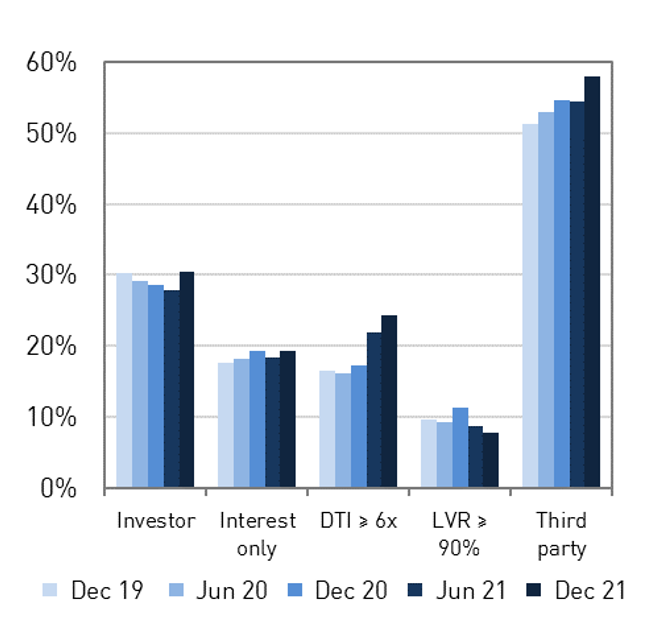

Mr Byres said that APRA would be “watching closely” the experience of borrowers who have borrowed at high multiples of their income – particularly given that this cohort has “grown notably over the past year” (as below).

Source: APRA

According to the regulator, this increase in high debt-to-income (DTI) ratio lending was not systemic, but more “concentrated in just a few banks”. (Indeed, several lenders – including ANZ and NAB – have both recently reduced their DTI limits to ensure they are lending “prudently”).

He added that APRA had therefore opted to tackle its concerns on a bank-by-bank basis, rather than opt for any form of macroprudential response (as had been speculated last year).

“We expect lending policy changes at those banks, coupled with rising interest rates, will see the level of high DTI borrowing begin to moderate in the period ahead,” he said.

However, Mr Byres added that the expected decline in housing prices would, on balance, be “a positive development from a system stability perspective” because it would reduce the need for borrowers to borrow “very high multiples” of their incomes.

“Nonetheless, given the importance of mortgage lending to the stability of Australian banking system, you can expect us to maintain a very close eye on developments,” he said.

In conclusion, Mr Byres said that he believed the banking industry was “well placed to weather a more difficult environment”, and did not expect a deterioration in housing loan portfolios to cause “system stability issues”.

The APRA chair concluded: “There are hazards ahead, but the banking system appears well-equipped to navigate them. Whether it is the health of housing portfolios in a rising interest rate environment, the impact of climate change, or the implications of digital innovation – all of which are big issues on [the event agenda] – there are undoubtedly challenges that must be overcome.

“But a financially strong, competitive and innovative banking system should give us plenty of confidence that we can do so.”

[Related: ANZ tightens high-risk lending]

;

;