The latest Roy Morgan research has revealed a “record high” of 1,496,000 (29.2 per cent) of mortgagors were “at risk” of mortgage stress in the three months to July 2023.

During this period, the Reserve Bank of Australia (RBA) lifted the official cash rate twice by 25 bps, which brought interest rates to 4.1 per cent.

According to Roy Morgan, these figures surpassed the previous record-high number recorded in the three months to May 2008 of 1.46 million.

Over the last year, the number of borrowers reaching the “at risk” category increased by 642,000.

Furthermore, the number of mortgage holders falling into the “extremely at risk” category also increased by 1.01 million (a proportion of 20.3 per cent), which sat well above the long-term average over the last 15 years of 15.4 per cent.

However, despite the proportion of 29.2 per cent being a record high, it still remains below the record highs recorded during the global financial crisis (GFC) due to the larger size of the Australian mortgage market today, according to Roy Morgan. The record high of 35.6 per cent of at risk of stress mortgagors was reached in mid-2008.

Roy Morgan has warned that mortgage risk could increase to over 1.57 million should the central bank decide to raise the official cash rate by a further 25 bps during the September monetary policy meeting, which would leave the cash rate at 4.35 per cent.

If the RBA does decide to lift rates in September, the proportion of mortgage holders at risk of stress would increase to 30.2 per cent by the end of the quarter.

Should there be a subsequent lift in October to bring the cash rate to 4.6 per cent, Roy Morgan stated that 30.7 per cent of mortgage holders (1.6 million) will be considered at risk of stress.

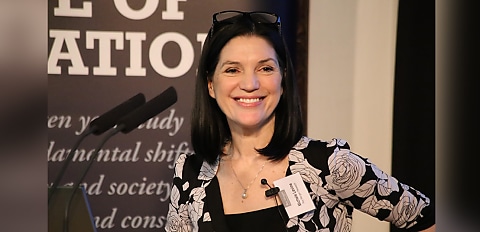

Roy Morgan chief executive Michele Levine said: “The figures for July 2023 take into account all 12 RBA interest rate increases which lifted official interest rates from 0.1 per cent in May last year to 4.1 per cent by June 2023. Since then, the RBA has decided to leave interest rates unchanged at its two most recent meetings in July and August.

“Although many have suggested the RBA has finished its cycle of interest rate increases, the low Australian dollar and high petrol and energy prices adding to inflation may force their hand for further interest rate increases in the months ahead.”

[RELATED: ‘Historical high’ for mortgage repayments projected: RBA]