What is a zombie company? It’s a business that continues to operate even though it is unable to generate enough profits to cover its debt payments. These companies often survive by borrowing more money or restructuring their existing debt, but they are essentially “living dead” in the sense that they aren’t growing.

According to a report from Kearney titled Zombie Buyers Beware, this phenomenon is steadily rising. Last year, the number grew by 7.8 per cent and now these zombie companies make up 5.8 per cent of all publicly traded businesses globally.

Investors are reportedly spending top dollar on these companies as in the first year after a deal they can “generate double-digit total shareholder returns that are comparably higher than those of their non-zombie counterparts.”

Australia is especially susceptible to this trend, with the APAC region seeing an increase of 10.7 per cent. Australia was even ahead of the average, with a 13.6 per cent increase in zombie companies.

Causes are pinned to inflation, rising interest rates, and economic instability. Those in the real estate industry are more likely to fall victim to these trappings than any other sector. It doesn’t matter what size the company is either, as zombies can be found among small, medium, and large businesses. However, those with annual revenue of $500 million or less are the most likely to be affected.

Some investors are actually keen on acquiring zombie companies, said Kearney. However, it is a risky venture as there is a small window of opportunity to bring life back to the organisation.

Adam Holster, professional services banking executive at NAB, said on the trend: “There are some industries that have been impacted more than others by local consumer preferences and also geopolitical events – a combination of those things, the ending of government COVID-19 related stimulus and diligent ATO collections has seen a rise in insolvencies.

“I would caution against catastrophising the current insolvency rate given that this rise of companies entering external administration as a portion of total registered companies is less than in 2012. What we are seeing is an increase in the number of trade trough’s meaning a voluntary administration is being used as a step to restructure the business to ensure its ongoing survival.”

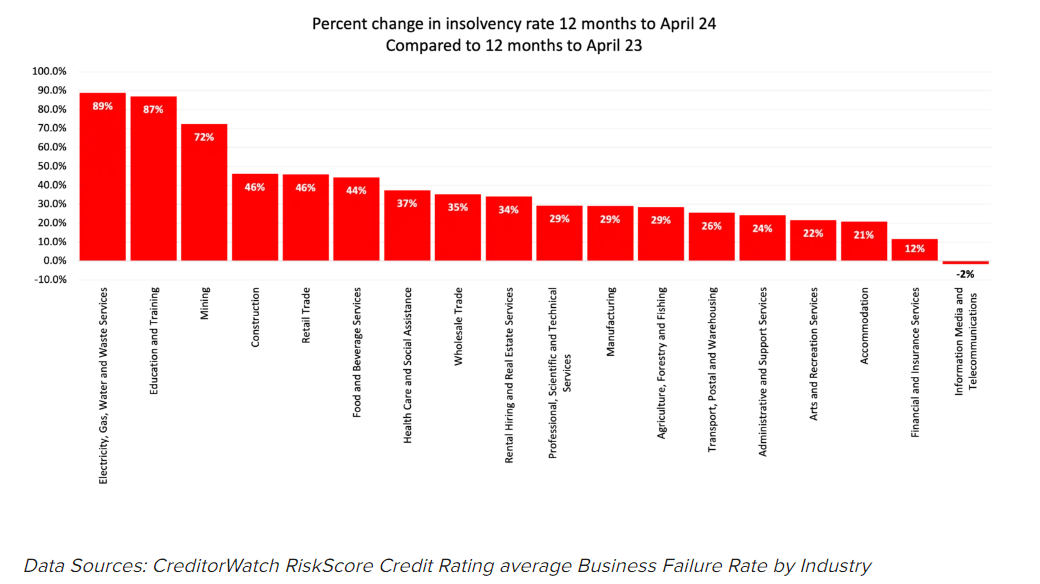

Holster provided a graph that analyses the insolvency rates of organisations by industry:

There are a variety of issues that a rise in zombie companies can have on the economy. Most prevalent, said Holster, is a false sense of security.

“Zombie or distressed companies can provide a false sense of security for employees, their customers, suppliers and investors. Companies who are in distress benefit from proactively working with their financer, supplier, and employees in collaboration with an insolvency expert and/or broker and can often create a future structure and trading scenario that supports the ongoing viability and growth of the business,” he said.

For investors and brokers, awareness of the issue can help prevent running into issues with zombie companies.

“Investors and brokers should continue to do their due diligence before making an investment or taking on a new client … We want to ensure we are backing businesses for growth by connecting professional services businesses to the right networks, and other industry players and thought leaders, that have the capability to help them get the best outcome for their customers,” said Holster.

[Related: Is the government trying to push out investors?]