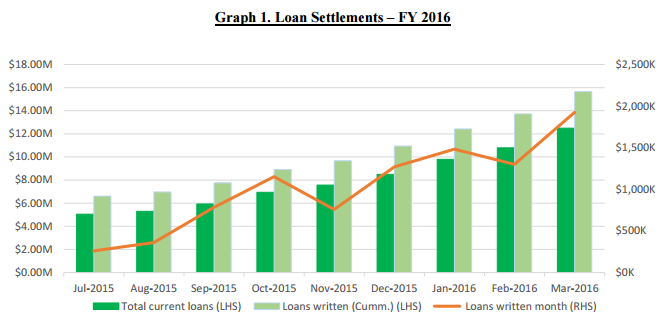

The relatively new third-party lender told shareholders last week that $1.92 million loans settled in March, up from its previous record month of $1.5 million of loans settled in January.

The third quarter of the 2015-2016 financial year has also been a record period for the personal loan provider, with $4.71 million loans settled, up 48 per cent over the previous quarter.

“Loan origination growth [is] being driven by strong partnerships with broker aggregators and direct online channel marketing,” the group said in an ASX trading update.

“As at 31 March 2016, $12.5 million of current loans written by DirectMoney to 689 borrowers were owned by parties including DirectMoney, Macquarie Bank, the DirectMoney Personal Loan Fund and a major shareholder.

Source: DirectMoney Limited

“The strong momentum in loan settlement volumes further validates DirectMoney’s strategy of establishing multiple partnerships with broker aggregators, as well as building its market presence directly with consumers through online channel marketing.”

DirectMoney chief executive Peter Beaumont said he was “tremendously pleased” to report that the team had delivered a record lending month in March 2016 and a ~50 per cent uplift quarter-on-quarter.

“Both our direct and broker channels are performing, proven and expanding. DirectMoney’s market visibility continues to grow both directly with consumers and through third-party channels,” Mr Beaumont said.

“The growth opportunity is best highlighted by the fact we have agreements with an initial ~350 accredited brokers out of ~4,500 brokers that are affiliated with our broker aggregator partners,” he said, adding that growing the number of brokers that originate DirectMoney loans is an ongoing focus for the lender.

Mr Beaumont said the loan origination performance in the quarter augured well for future origination volumes and DirectMoney’s ongoing growth.

“While loan settlements are pleasing, volumes are still in their infancy. With the necessary infrastructure and technology platform now in place, our team is fully committed to realise our vision of establishing DirectMoney as Australia’s leading marketplace lender,” he said.

[Related: DirectMoney announces new credit data deal]