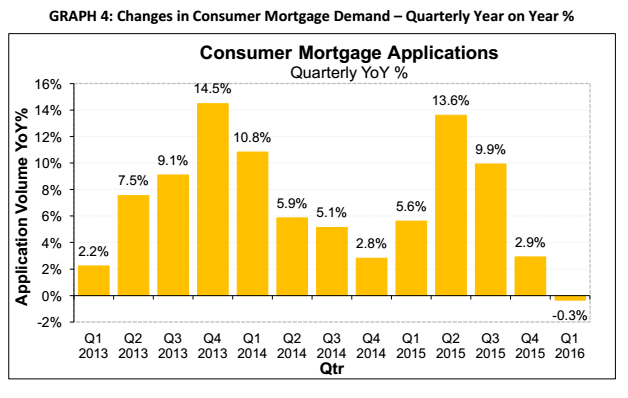

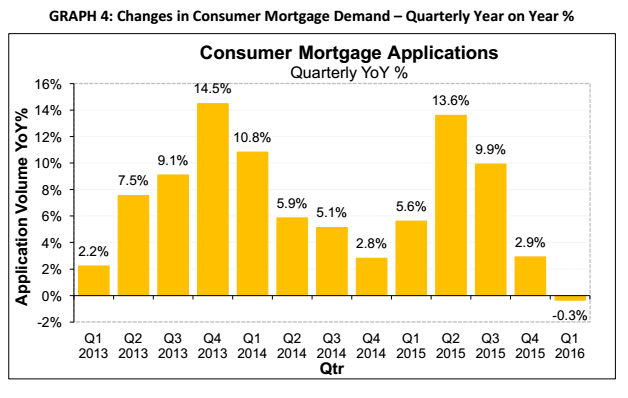

The Veda Quarterly Consumer Credit Demand Index shows the annual rate of growth in mortgage applications slowed from 13.6 per cent in the June quarter of 2015, to an annual rate of decline of 0.3 per cent in the March quarter of 2016.

The sharpest slowdown in mortgage application growth was seen in NSW. In the June quarter 2015, mortgage application growth in NSW was as high as 21.7 per cent; it is now showing an annual rate of decline of 1.2 per cent.

Mortgage applications have also declined over the past year in Tasmania (-10.8 per cent), WA (-13.9 per cent), and the NT (-13.9 per cent). Elsewhere, mortgage applications growth was still seen in Victoria (+5.9 per cent), SA (+2.5 per cent), Queensland (+1.6 per cent) and the ACT (+0.5 per cent), but growth was down significantly from recent peaks in all of these jurisdictions.

The Veda index noted that historically, movements in Veda mortgage applications have tended to lead movements in house prices by around six to nine months, with mortgage applications a good indicator of home buyer demand and housing turnover.

Source: Veda Quarterly Consumer Credit Demand Index (March 2016 Quarter)

“The cooling demand for mortgages is consistent with other recent indications of cooling in the housing market, including auction clearance rates that are down from last year’s peaks in Sydney and Melbourne, and a slowdown in house price growth,” the report noted.

While the latest data indicated a more subdued housing market in 2016, Veda reported an upwards shift in the relative share of mortgage applications by consumers in younger demographics.

Angus Luffman, Veda’s general manager of consumer risk, said that from late 2012 to December 2014, the proportion of mortgage applications by the youngest demographic (18-24) decreased, while the proportion of applications by the oldest demographics (55-64 & 64+) increased.

“This would appear to support the growth of investment lending over owner-occupier, particularly impacting younger consumers,” Mr Luffman said.

“In the last two quarters, this trend has ceased and is showing early signs of reversing. This is likely indicative of the impacts of the Australian Prudential Regulation Authority (APRA) driving policy changes on investment lending,” he said.

[Related: Veda records surge in high risk loan applications]

;

;