The Australian Prudential Regulation Authority (APRA) has released its authorised deposit-taking institutions (ADIs) statistics for April, revealing that the total residents loans and finance leases held by Australia’s banks grew by just over $26 billion (or 0.8 per cent) to just under $3.15 trillion during the month.

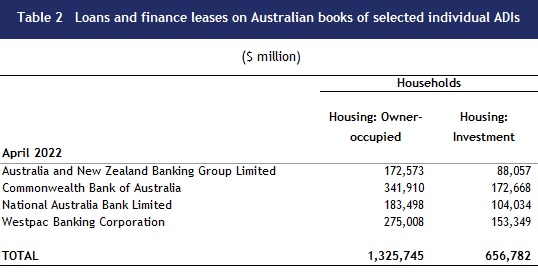

The growth was partly driven by an increase in home lending to owner-occupiers, with a $7.0 billion (or 0.5 per cent) increase to $1.32 trillion and a 0.5 per cent rise in investor loans, taking this segment to $656.78 billion.

For yet another month in a row, ANZ’s owner-occupier loan book dropped, decreasing by around $300 million to $172.5 billion in April.

However, as ANZ’s investor book rose from $87.6 billion to $88.05 billion last month, it closed off the month of April with its overall book marginally up – at $260.63 billion.

ANZ has previously acknowledged falls in its home loans book, which it attributed to stretched turnaround times for approvals, during a flurry of activity it was unprepared for. The group has been working to reverse the decline, under the eye of its group executive for Australian retail, Maile Carnegie, though it recently stated that it was a “tougher environment for us at ANZ and for the industry” in a “very, very competitive period of time”.

The major bank announced earlier this week that it was lowering its debt-to-income ratio to 7.5 times, from nine times, to “to ensure we are continuing to lend prudently to [its] customers” but increased its maximum loan-to-value (LVR) threshold to 95 per cent (or 97 per cent with capitalised LMI premium) for new-to-bank customers that have a DTI under 6.

On the flip side, however, both the Commonwealth Bank of Australia (CBA) and National Australia Bank (NAB) saw marked growth in their owner-occupier books in April.

Australia’s largest bank, CBA, recorded an increase in its overall loan book by around $2 billion once again (to $514.57 billion), driven by a $1.2 billion increase in owner-occupier loans.

It finished the month of April with $341.91 billion in owner-occupier loans, and around half a billion dollars more in its investor book (to $172 billion).

Similarly, NAB continued to rapidly bolster its owner-occupier book, with its total book for this segment also rising by about $1.2 billion (although from a smaller base), to $183.49 billion.

Meanwhile, NAB’s total loans to households for investment purposes finished the month of April at $104.03 billion – up around $400 million on the month prior.

Westpac’s loans and leases to households also increased, coming in at $428.35 billion at the end of April after its owner-occupied book grew by around $600 million to surpass $275 billion.

However, its investor book dropped on the month, falling by around $300 million to $153.34 billion.

[Related: ANZ tightens high-risk lending]

;

;

Comments (0)