Since 2 June, following its $1.2 billion acquisition, National Australia Bank (NAB) has operated Citi’s consumer business.

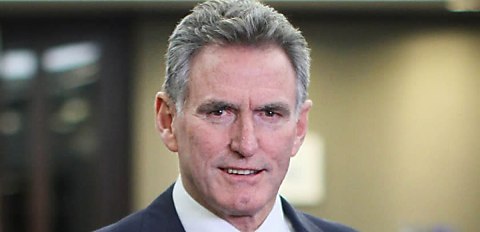

Speaking at the time of the deal’s completion, NAB chief executive Ross McEwan commented that the transaction would support the banking group’s vision to build “a leading personal bank”.

According to NAB’s latest figures for the June quarter (Q322), this purchase added $13.2 billion to its gross lending balance, $9.2 billion of which being for home loans.

The big four bank has said that the remaining $4 billion were credit cards and “other unsecured personal lending”.

Further, NAB has said that the addition of the Citi consumer business contributed $9.4 billion to deposit balances as well as 1 basis point (bp) to its net interest margin over the quarter.

More broadly, NAB’s latest figures also reported that the bank reached a figure of $1.85 billion in unaudited statutory net profit, as well as unaudited cash earnings of $1.8 billion.

The big four bank said that its cash earnings — before tax and credit impairment charges — was 2 per cent higher than the quarterly average of 2022’s first half, and 10 per cent more than what was reported 12 months earlier.

Credit impairment charges were also said to be $11 million, dropping from the previous quarter’s $37 million.

The ratio of 90+ day past due and gross impaired assets to gross loans and acceptances declined from 75 bps to 70 bps over the three months, marking the fifth consecutive quarterly drop.

During the second quarter of 2021, this figure was 1.23 per cent.

Speaking of the results, Mr McEwan said the figures highlight NAB’s ongoing execution of its strategy, which includes the acquisition of Citi’s consumer business.

Mr McEwan added that, excluding the Citi purchase, lending increased by 2 per cent over the June quarter while deposits bumped by 4 per cent.

“Our business is also in good shape for this evolving environment,” Mr McEwan later said.

“Balance sheet settings remain strong and we are well advanced on our FY22 term wholesale funding task with $34 billion raised by end June.

“Investments to deliver simpler, more digital experiences for customers and colleagues are supporting balanced growth and productivity benefits which are expected to exceed $400 million in FY22.”

The CEO concluded that NAB has a clear strategy and that “executing this with discipline” is its “key priority”.

“We will continue to focus on getting the basics right, managing our bank safely and improving customer and colleague outcomes to deliver sustainable growth and improved shareholder returns.”

[Related: NAB finalises $1.2bn Citi acquisition]