National Australia Bank (NAB) has revealed it will pursue “greater opportunities for growth” in its business banking arm and reiterated that while it is not chasing mortgage growth, it would not be completely abandoning its mortgage business.

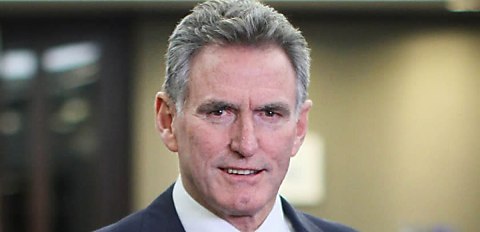

Speaking at the release of its 2023 full-year results for the 12 months to September 2023 (FY23), the lender’s CEO Ross McEwan stated that the bank would send additional capital and liquidity into its business bank because it sees “greater opportunities there for growth” given the better returns.

Mr McEwan said yesterday (9 November) that its FY23 performance had “supported another year of strong growth” in its SME franchise, with business and private banking having increased lending by 8 per cent to $143.3 million. This included a 24 per cent growth in small-business lending.

The business arm also grew deposits by 8 per cent to $206.1 million, underpinning a 22 per cent rise in underlying profit for the division, to $5.31 billion in FY23.

Mortgage growth moderates

NAB’s mortgage book grew 1.5 per cent to a total balance of $338 billion in September 2023 from $329 billion in September 2022.

Speaking of the figures, the NAB CEO flagged that the bank had taken a “disciplined approach” to originating new home loans due to “much softer margins” and “a number of sector headwinds”. These included heightened refinancing activity and “competitive pressures”.

“In other sectors such as Australian housing, we took a more measured approach to growth this year with a focus on returns,” Mr McEwan said.

NAB’s share of system growth reduced from 1.1 times in FY22 to 0.7 times in FY23.

The bank also revealed that the total drawdown loan balances were $40 billion in September 2023, down from $42 billion the previous year.

The average loan size grew by $24,000 in the year, from $334,000 to $358,000.

Broker flows increase

Just under half of NAB’s entire housing loan portfolio has now been originated through the broker channel (49.6 per cent), up from 46.1 per cent last year, according to the financial results.

Mortgage brokers were also responsible for the majority of NAB’s new mortgage business, with just under two-thirds (64.3 per cent) of new flows coming through the broker channel. This is an 8 per cent increase when compared to the previous year (59.3 per cent).

While around $62 billion in fixed loans expired over the 18 months to September 2023, NAB has revealed that “a good chunk of [its] fixed rates are rolling over”.

According to the results, 20 per cent of its overall book remains fixed.

Approximately $53.7 billion in fixed loans is set to expire in the next 18 months (to March 2025), with an additional $13.9 billion rolling off after that.

There was a slight rise in the 90-plus days arrears levels at NAB, rising 9 bps to 0.76 per cent. However, this was still below the pre-pandemic rate of 0.98 per cent (FY19).

The lender said that $145 billion of loans originated during the low interest rate period between August 2019 and July 2022 contributed to the rise in the arrears rate, which was “consistent with seasoning at this stage”.

Looking ahead, the lender stated that it would continue to invest in its Simple Home Loans product, as it looks to “enhance the customer and broker experience”.

Approximately 15 per cent of all broker home loans were submitted through the Simple Home Loans product, with 50 per cent of loans written by brokers now eligible for the product. It anticipates that it will complete the end-to-end roll-out for brokers across FY2024–25.

Following the Reserve Bank of Australia’s (RBA) rate rise on Tuesday (7 November), Mr McEwan said he believed there would be a “fairly benign market for interest rates” over the coming year, stating that he believes he thinks “we’re getting close to the top of the cycle”.

NAB has announced that it will be passing on the 25-bp rate rise to both its standard variable home loan interest rate and NAB Reward Saver bonus interest rate, from 17 November.

[Related: Cup Day hike to take ‘heat out of the housing upswing’]