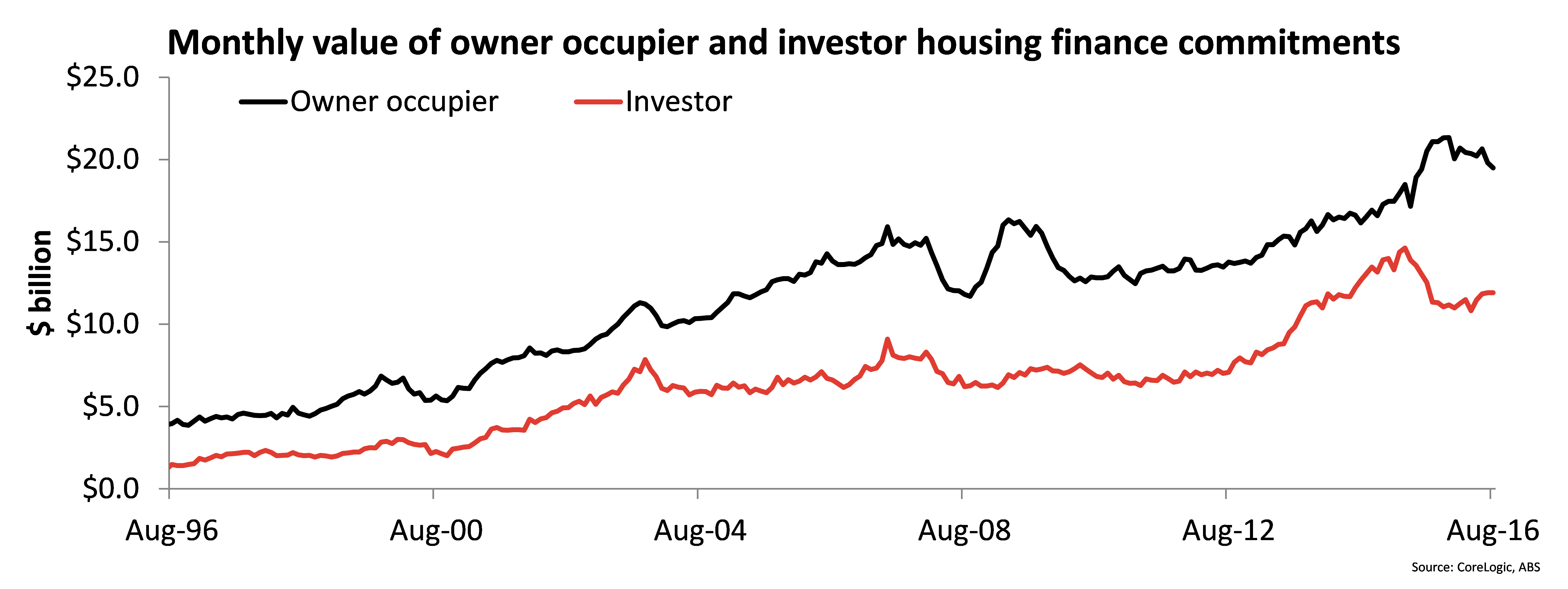

The $31.4 billion worth of commitments in August was split between $19.5 billion worth of commitments by owner occupiers and $11.9 billion in commitments to investors. The value of lending to owner occupiers has fallen over two consecutive months while lending to investors has risen for the fourth consecutive month. The value of lending to owner occupiers is now -8.6% lower than its peak in December 2015. Investor lending remains well below its April 2015 peak, down -18.5% however, the recent rebound has seen the value of investor lending increase by 10.0% from its recent trough in April 2016.

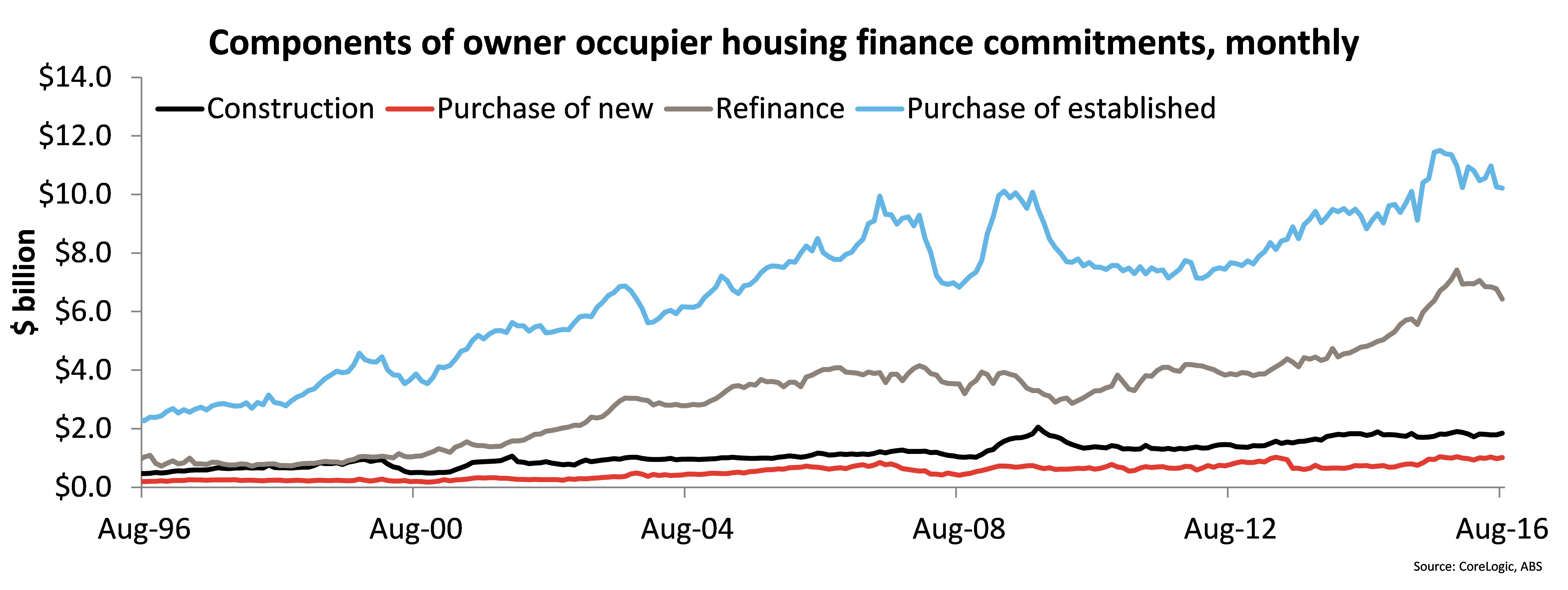

The $19.5 billion worth of mortgage borrowing by owner occupiers was comprised of: $1.8 billion for construction of dwellings, $1.0 billion for purchase of new dwellings, $6.4 billion for refinancing of established dwellings and $10.2 billion for purchase of established dwellings. The two largest components of owner occupier lending; refinancing and purchase of established dwellings, have both trended lower over recent months. The value of refinance lending is -13.4% lower than its peak of $7.4 billion in December 2015 and purchase of established dwellings is -11.2% lower than its $11.5 billion peak in September 2015. With an interest rate cut which wasn’t passed on in full by most lenders in August, there is a decent probability that refinance activity will increase over the coming months.

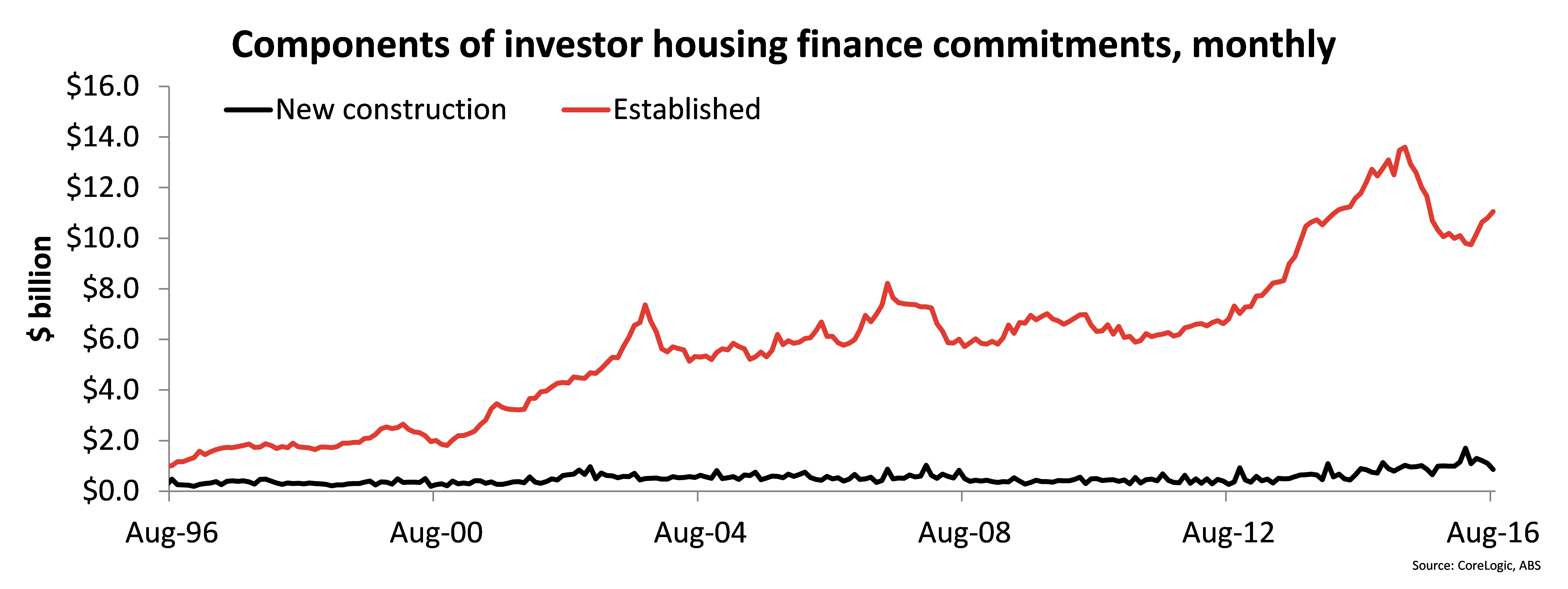

For investors there was $11.9 billion in mortgage lending in August 2016, which was split between $0.9 billion in lending for construction and $11.1 billion for established housing. The value of lending for construction was at its lowest level since September 2015 and down -49.5% from its recent peak of $1.7 billion in March 2016. The $11.1 billion in lending for established housing has increased over four consecutive months and is at its highest level since August 2015. Housing credit data also highlights the recent up-tick in investor mortgage lending with monthly investor credit data increasing over each of the five months to August 2016.

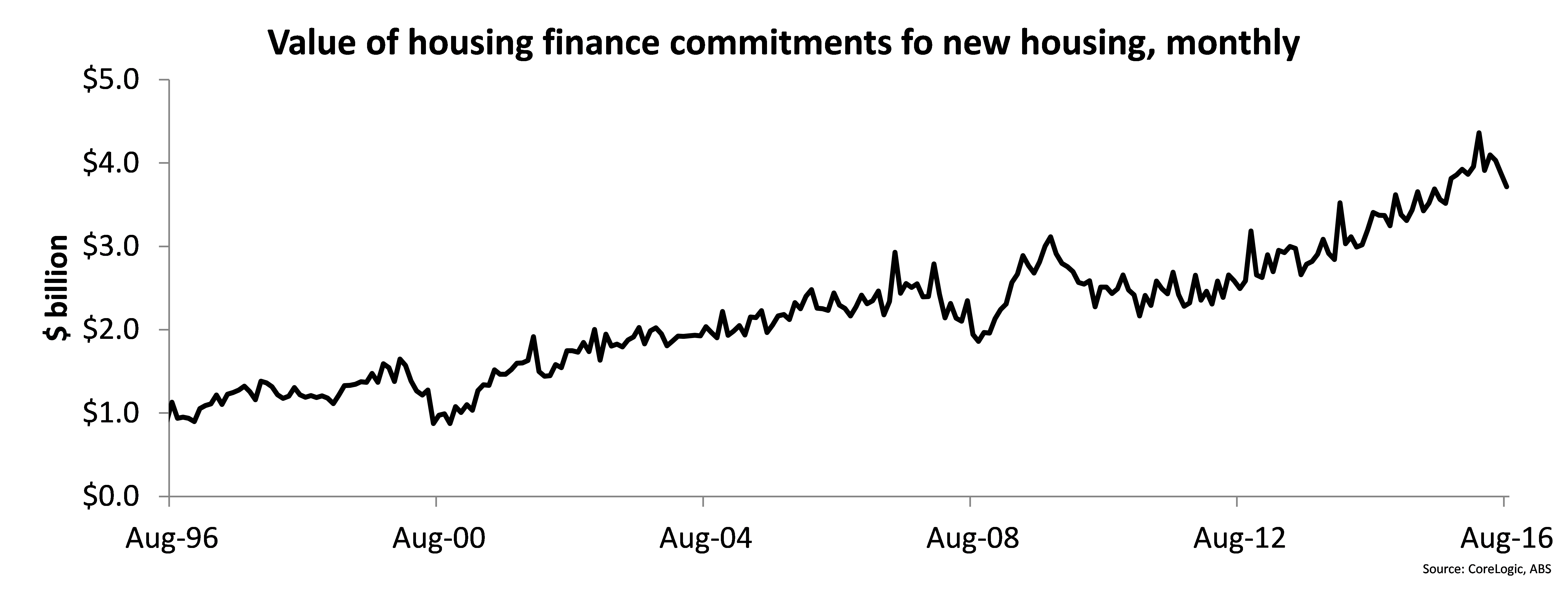

Focusing solely on new construction which includes owner occupier construction of dwellings, owner occupier purchase of new dwellings and investor lending for construction, there was $3.7 billion in lending in August 2016. The $3.7 billion was the lowest value of lending for new housing since September 2015 with lending for new housing having trended lower since March 2016. Based on this data, only 14.9% of the total value of housing finance commitments in August 2016 were for new housing. Of the $3.7 billion, 23.1% of lending was to investors.

The trends are emerging whereby demand from the investment segment is increasing again while owner occupier demand is slowing. Although investment demand is lifting, it is not expected to lift to the substantial levels recorded earlier in the current housing cycle. The fading demand from owner occupiers reflects that many have already upgraded or downgraded in the current cycle as much as the fact that particularly in Sydney and Melbourne it is probably getting a little harder to justify a move in the context of significant transactional costs. When owners look at the cost of upgrading and the market exit cost (agent commission etc) and entry costs (stamp duty) many are probably now considering a renovation as a better option than moving.

Housing market listings have increased in spring and over recent months auction volumes and clearance rates have also increased. It will be interesting to see whether this translates into a lift in housing finance commitments over the coming months as the data becomes avaialable.

;

;