Unsurprisingly, as the country transitions out of lockdown, Australia’s GDP also rebounded from historical lows reaching 3.3% in the September quarter. Whilst the country is now technically out of a recession, the future for many businesses remains uncertain, with 2021 likely to be the year that will separate the winners from the losers.

Now more than ever, taking a holistic approach to servicing a customer’s current and future needs will become vital to the success of any broker. It will be critical that brokers offer alternative working capital solutions to keep businesses running and transform conversations into growth-based discussions.

The SME Index and K-shaped recovery

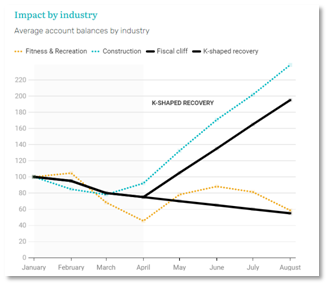

While growth prospects and increased spending are encouraging, not all sectors of the economy are bouncing back evenly. As JobKeeper and other Government programs are reduced or phased out altogether, many businesses around the country could struggle to stay afloat.

According to GetCapital’s SME Index,the recovery - much like the impact of COVID - has not been uniform across industries.Data by sector reveals two diverging groups in more of a K-shaped recovery – with relatively resilient industries building savings rapidly, while others struggle to maintain working capital reserves or even going backward.

What this means for brokers

What this means for brokers

When it comes to servicing your customers, it can be useful to leverage this type of industry data and insights to tailor your approach. The SME Index can be used as a leading indicator to help you calibrate your focus to specific sectors as they go through transition. With special reports on JobKeeper Payments and SME Savings, you’ll understand the impact of COVID and Government programs on turnover, cash flow gaps and determine when or if businesses can become self-sustaining as conditions improve.

As a broker, you have a deep understanding of your customer’s needs, financial circumstances and future goals.You are uniquely placed to deliver a more holistic perspective on managing cash flow and to offer alternative working capital solutions to keep businesses running.

Start the conversation today

As businesses transition out of the pandemic, their need for working capital will change. And a typical business term loan may not be the right solution over time for a growing business. That’s why nearly 50% of business owners prefer some form of revolving debt to manage day-to-day cash flow needs. When it comes to business finance, they especially value access, flexibility and certainty.

Transforming your conversations into growth-based discussions is easy.

- First, learning about your customers’ debt profile can give you great insight into their current financial obligations, cash flow and working capital requirements.

- Benchmarking against similar businesses will provide insight into current and future needs, while providing additional value to your customers by deepening the conversation. Subscribe to our SME index to gain access to industry data.

- Other key pieces of information to understanding and qualifying your customers are determining their average monthly or annual turnover, overall trading time and credit history.

Looking beyond the point of funding

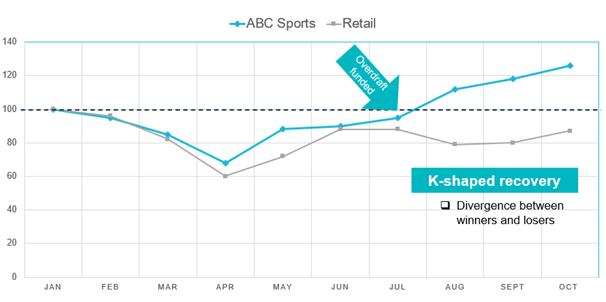

For many, the obligation of a finance broker will usually cease at the point of funding with a post funding call cycle established to nurture the customer relationship and identify future finance needs. With this approach, what is often not seen is the physical impact to the business once funding has been established and the money put to work. In this case study, we look at how the facility has benefited the business beyond the point of funding.

|

Customer Case Study: ABC Sporting Goods This bricks and mortar sporting goods store operates in three states across the east coast. It’s both a wholesaler and retail arm supporting a broad range of product lines. Due to COVID, 30% of its revenue was negatively impacted.Several of its 16 staff were on JobKeeper for few months. Customer required capital to rebuild website, increase advertising spend, and purchase additional inventory to cater for changes in consumer behaviours. |

Watch the full discussion, click here.

;

;