The Real Estate Institute of Victoria (REIV) has taken out full-page advertisements in several large metropolitan newspapers on Wednesday (8 September), highlighting concerns relating to the impact of the state’s ongoing lockdown on the property market.

The advertisement will also be distributed via social media channels and emailed directly to REIV members.

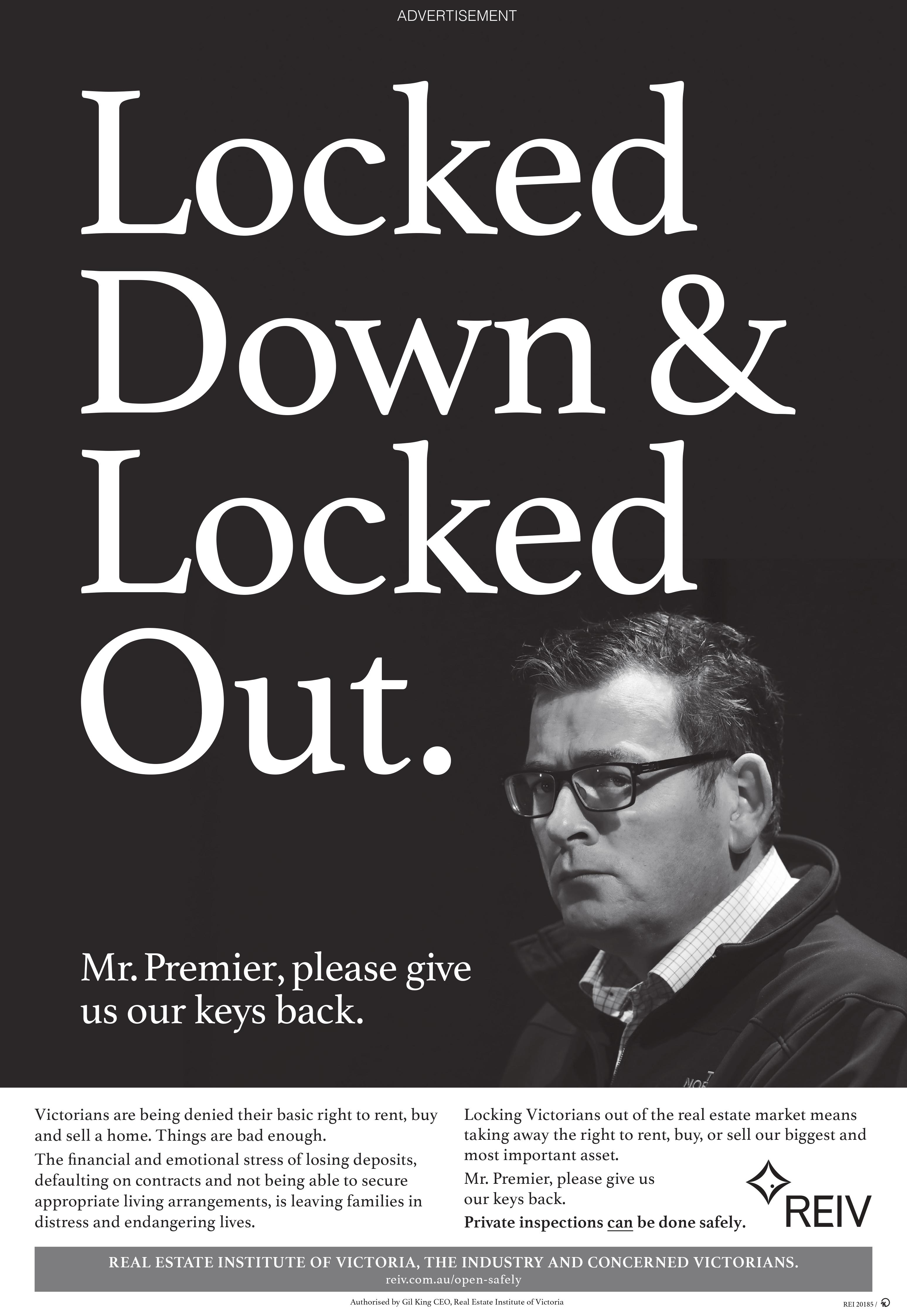

It read: “Locked down and locked out. Mr Premier, please give us our keys back,” featuring an image of Premier Daniel Andrews.

“Victorians are being denied their basic right to rent, buy and sell a home. Things are bad enough.

“The financial and emotional stress of losing deposits, defaulting on contracts and not being able to secure appropriate living arrangements is leaving families in distress and endangering lives.

able to secure appropriate living arrangements is leaving families in distress and endangering lives.

“Locking Victorians out of the real estate market means taking away the right to rent, buy, or sell our biggest and most important asset.

“Mr Premier, please give us our keys back.

“Private inspections can be done safely.”

The REIV said it had taken out the advert to display the sector’s concern that one-on-one property inspections cannot be undertaken under current Victorian government COVID-19 regulations.

It said that this was impacting “tens of thousands” of sector employees and Victorian residents.

REIV chief executive Gil King added that the campaign followed “a failure” of the Victorian government to understand that the property sector could “operate safely during a pandemic”.

“Ever since the beginning of COVID-19, the REIV, on behalf of the sector, has outlined that private property inspections – residential and commercial – can occur safely,” Mr King said.

“We have made dozens upon dozens of representations to the Victorian Government but are repeatedly ignored. We are determined to ensure the message gets through, and if taking a more public stance means the voices of Victorians are heard, then we are prepared to invest resources into that approach.”

REIV president Leah Calnan added: “When Victorians buy, sell or rent a property, they are making some of the most significant financial decisions of their lives. In-person inspection is a fundamental aspect of property transaction due diligence. Without it, buyers and renters are flying blind, and sellers and rental providers aren’t able to position their asset at its best.

“Lockdown regulations that ban property inspection by private appointment are creating an unnecessary burden on the property market, impacting aspiring homeowners and mum and dad investors. Most critically, though, they’re stopping many people from being able to access rental properties so they can put a roof over their heads.

“Banning inspections effectively shuts down the property sector, which rubs salt into the wounds of an industry that has been excluded from government financial support despite its significant economic contribution through the employment of thousands of people and the payment of billions of dollars in taxes.”

Mr King concluded by saying that the group “shudder[ed] at the thought of potential longer-term consequences” of the restrictions given that the “suffocating” and “unnecessary” rules were “already impacting the health, safety and mental well-being of the community”.

“The REIV is ready and willing to work with the Victorian Government in finding the solutions that enable business to resume while ensuring the safety of all Victorians,” he said.

[Related: NSW removes lockdown exemption for investors]

;

;