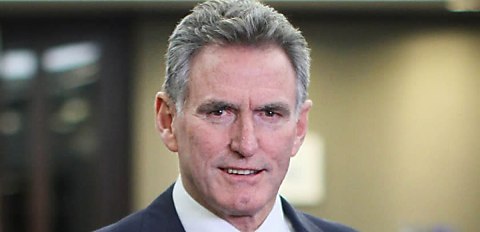

NAB CEO Ross McEwan reflected on the major issues facing the country in the year ahead and finding a solution to the ongoing housing crisis remains top of mind for the CEO.

“Housing is Australia’s biggest issue – it will continue to have a disproportionate impact on young and vulnerable Australians if we don’t get the settings right now,” Mr McEwan said.

“I worry that the great Australian dream of owning your own home is at risk.

“Affordability is at a 30-year low, and rental prices are rapidly increasing. That’s because we simply don’t have enough houses for our growing population, let alone enough affordable and social housing for people who need support.”

Indeed, the latest Housing Affordability Index released by PropTrack in September 2023 revealed housing affordability dropped to a 30-year low as of June 2023, largely driven by surging home prices during the COVID-19 pandemic and the Reserve Bank of Australia’s (RBA) aggressive monetary policy tightening cycle.

Additionally, the most recent data from CoreLogic’s Home Value Index (HVI) found that home values rose 8.1 per cent over the course of 2023, recovering from the 4.9 per cent decrease recorded in 2022, yet still below the 24.5 per cent spike recorded in 2021.

“The gap between supply and demand has increased significantly. We’re building around 50,000 homes less than we need each year,” Mr McEwan continued.

The CEO added that all levels of government “urgently need to collaborate on simpler and faster regulations, while freeing up land suitable for building”.

“There also needs to be more targeted government support for social and affordable housing and more innovative construction methods to meet supply targets, such as modular housing,” he said.

The lack of new housing construction was also flagged by the Housing Industry Association (HIA), which warned that Australia was not commencing enough housing to fulfil the government’s 1.2 million target.

This followed the release of new dwelling commencements data by the Australian Bureau of Statistics (ABS), which revealed that the number of new homes being built had fallen 10.4 per cent (seasonally adjusted) to a new decade low.

Mr McEwan said the major bank wants to assist with the housing supply issue and lend an extra $6 billion for affordable and specialist housing by 2029.

“Last year we invested $67.5 million into a specialist disability accommodation portfolio through Lighthouse Infrastructure,” Mr McEwan concluded.

“NAB also supports social and affordable accommodation projects through Nightingale and Good Shepherd.

“This issue is not just for governments to solve. Banks, developers, builders and community partners can all move faster.”

[RELATED: Dwelling commencements fall to decade low]