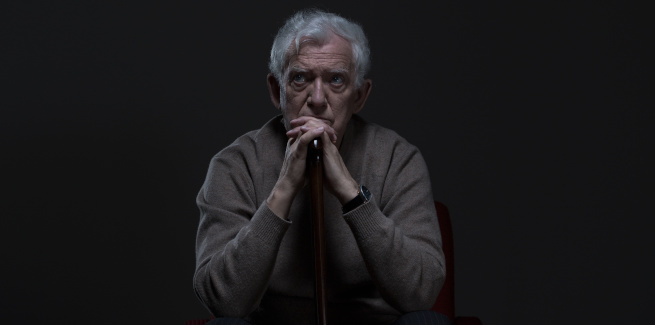

The call comes as advocates, policymakers, community groups and business organisations gather in Hobart (14-15 February) to work towards eradicating elder abuse.

With 10 per cent of older Australians experiencing “financial abuse”, Australian Banking Association (ABA) chief executive the Honourable Anna Bligh AC is calling on federal and state attorneys-general to commit to deliver reforms to protect older Australians.

Alongside the Age Discrimination Commissioner, Dr Kay Patterson AO, Ms Bligh is urging attorneys-general to implement the 2017 Australian Law Reform Commission (ALRC) recommendations from the inquiry into elder abuse.

This includes nationally consistent laws governing enduring powers of attorney (EPOA), including financial, medical, and personal, and establishing a national register of power of attorney instruments.

There also needs to be a body to receive and investigate reports on suspected cases of abuse in each state and territory jurisdiction.

While some states have systems in place, there is no uniform approach to reporting suspected financial abuse and the abuse is not investigated or acted upon.

In light of the current issues, Ms Blight said banks have put in a range of initiatives such as – “the development of an industry guideline preventing and responding to financial abuse, training staff to recognise red flags on transactions and providing digital tools and systems to help customers manage accounts, such as ‘two to sign’ arrangements”.

But, she said barriers for older generations still exist.

“The complexity created by the lack of harmonisation of laws between jurisdictions remains a significant barrier to real progress,” Ms Blight said.

“The effect of it is confusion for older people and their attorneys, unnecessary complexity for banks and other entities required to act on the EPOA, and it creates a system that contributes to financial abuse.”

She said the reforms will help ensure older Australians are protected from financial abuse.

“Our elderly Australians have worked hard over many years and deserve to live out their later years with dignity, respect and financial independence,” Ms Blight said.

Age Discrimination Commissioner Ms Patterson said elder abuse is “everyone’s responsibility” and this year’s conference will provide an “important platform” to share knowledge, exchange best practices and cultivate ideas to protect older Australians from financial forms of abuse.

“The Australian Banking Association and I have worked closely together to put this issue on the agenda in recent years, particularly calling on the Attorneys-General across Australia to harmonise powers of attorney which will have the effect of reducing the likelihood of financial elder abuse,” Ms Patterson said.

[Related: ABA calls on action for financial abuse]

;

;