The Compensation Scheme of Last Resort (CSLR) has estimated that $28.9 million will be needed to be paid to cover the costs of the first and second levy periods for the scheme.

The scheme – which will begin receiving claims from consumers from 2 April – aims to support consumers who have an Australian Financial Complaints Authority (AFCA) determination in their favour and have not been compensated as per AFCA’s decision.

While a pre-CSLR complaint estimate of $241 million has already been announced in order to cover complaints that were lodged with AFCA between 1 November 2018 and 7 September 2022 (and is being paid for by the 10 largest banking and insurance groups in the establishment phase of the CSLR), the next two levy periods will cover claims up to 30 June 2025.

These levies will facilitate the payment of up to $150,000 in compensation across five financial products and services, including personal advice on relevant financial products to retail clients, credit intermediation, securities dealing, credit provision, and insurance product distribution.

As outlined in the legislation for the CSLR, the first levy period will be funded by the Australian government and will meet eligible compensation claims and costs from the CSLR’s commencement on 2 April 2024 to 30 June 2024.

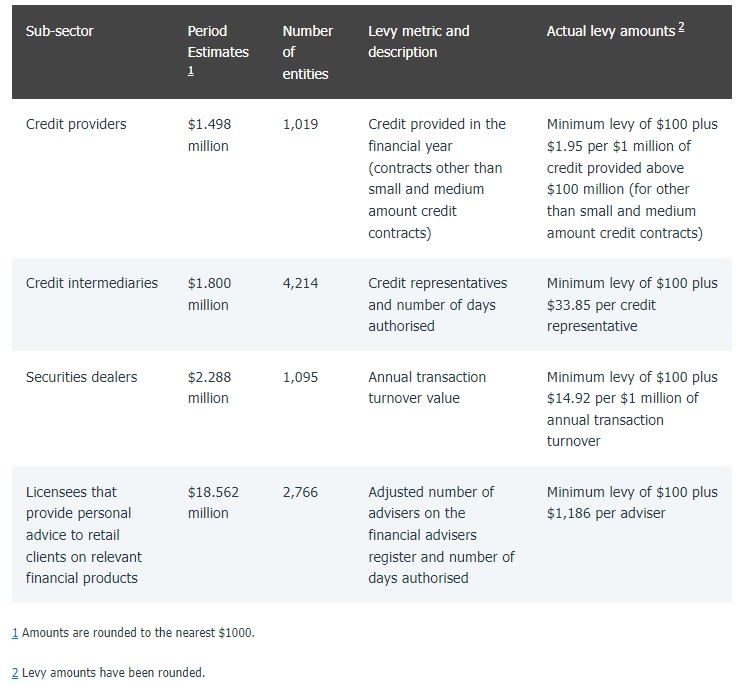

While financial firms will not contribute to the first levy period, the CSLR board has said the estimate falls within the legislated annual levy cap of $20 million for each sub-sector. The estimate for each sub-sector is:

- Financial advice, $2.4 million.

- Credit provision, $0.7 million.

- Credit intermediation, $0.8 million.

- Securities dealing, $0.9 million.

However, the second levy period – expected to meet eligible compensation claims and costs from 1 July 2024 to 30 June 2025 – will be covered by the sub-sectors of the financial services industry that are covered by the CSLR, including credit intermediation.

The estimate for each sub-sector is:

- Financial advice, $18.5 million.

- Credit provision, $1.5 million.

- Credit intermediation, $1.8 million.

- Securities dealing, $2.3 million.

The Australian Securities & Investments Commission (ASIC) will be responsible for issuing levy notices and collecting levy payments.

It said that the 4,214 credit intermediaries will have to pay a minimum levy of $100 plus $33.85 per credit representative for the Compensation Scheme of Last Resort.

Source: ASIC, Compensation Scheme of Last Resort

The financial services regulator has said it anticipates that it will begin to issue notices for the 2024–25 annual levy in “early August 2024”.

These will be available for account holders via the ASIC regulatory portal. Levies will be due for payment 30 business days after issue.

The second levy period estimate is subject to a “disallowance” period, with the federal Parliament having the opportunity to object to the estimate within 15 parliamentary sitting days of the legislative instrument being published on the Federal Register of Legislation.

Once 15 parliamentary sitting days have elapsed, ASIC will issue the levy for each of the financial firms and collect the levy on behalf of the federal government.

Announcing the levy estimates, the CSLR board said: “These latest estimates are another milestone towards the CSLR being able to meet compensation claims from the victims of financial misconduct.

“We are committed to a robust and rigorous process that allows us to make the best estimates based on the best information available.”

The estimates for the first and second levy periods were based on actuarial principles (determined by actuarial consultancy, Finity Consulting, and reviewed by a second actuarial consultancy, Taylor Fry).

[Related: New compensation scheme for misconduct victims]